Why the Yen Carry Trade Could Have a Big Impact on Crypto Markets

A financial expert warns that a yen carry trade run could be brewing, and it could pose a significant risk not only to traditional markets but also to Bitcoin and other digital assets.

What is a yen carry trade and why is it important?

The yen carry trade strategy is popular among global investors – borrowing yen at low interest rates and then reinvesting it in high-yielding assets like US bonds or tech stocks. The interest rate differential between Japan and major economies offers attractive returns.

However, the risk comes when the yen strengthens. That means investors need more dollars to buy back yen to repay the loan, reducing returns or even causing losses.

The Market Is Changing

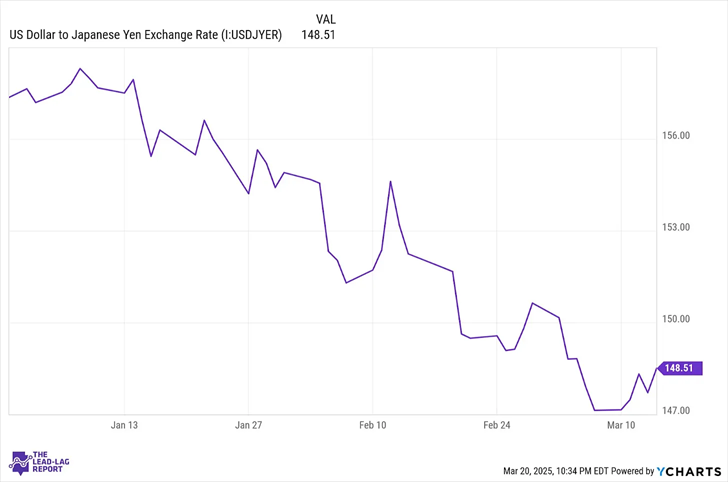

According to financial strategist Michael A. Gayed, the current signs are that these “carry positions” are gradually unraveling. He commented: “The cost of borrowing in yen is no longer as cheap as before. The yield on the 10-year Japanese bond has climbed to 1.56%, the highest level since 2008. This has reduced the attractiveness of the carry trade.”

In his report, Gayed also said that some investors are being forced to reduce their risk by selling dollar-denominated assets such as stocks and bonds, leading to downward pressure on global financial markets.

Impact on the US market and the consequences

He recalled that in August 2024, when the Bank of Japan unexpectedly raised interest rates, the yen rose sharply, causing a correction of nearly 10% on the S&P 500. The worrying thing is that this “shock” was only temporarily alleviated and never completely resolved.

Gayed believes that if Japanese interest rates continue to rise and the Fed lowers interest rates as predicted, the yield gap between the two countries will narrow, causing capital flows out of USD-denominated assets to be even stronger. That means the yen will strengthen further and the trend of fleeing from carry trade will continue to accelerate.

Is Bitcoin in the crosshairs?

The reason why Bitcoin is vulnerable lies in its increasingly close correlation with the S&P 500 index - a measure of the health of the US stock market. Analyst Lark Davis noted that since 2023, BTC price movements have been roughly in line with the S&P.

"The sad thing is that Bitcoin's behavior now depends heavily on what happens to the major Wall Street indexes," he said.

That means if the carry trade continues to unravel, leading to a sell-off in stocks, Bitcoin will almost inevitably be negatively affected, especially in the context of Bitcoin ETFs recording continuous capital withdrawals.

Pressure also comes from geopolitical factors and monetary policy

In addition to the inherent risks from carry trading, the market is also facing instability from trade tensions, especially after recent tough statements from President Trump on tariff policy. At the same time, the slowing US economic growth rate and the decrease in M2 money supply also contribute to tightening investment capital flows.

Bitcoin has fallen 3.1% over the past week, trading around $85,042, with a slight increase of 0.8% in the last 24 hours. However, the cash flow shows that investor sentiment is still cautious.

Will the storm continue?

Michael Gayed emphasized that the exodus from carry trade will not happen overnight, but can last for months, even years. With the increasing strength of the yen and the risk of leveraged debt, global financial markets, including cryptocurrencies, may witness huge waves in the late 2025 period.

"Japan – which seems so far away – is a very real danger. And the worst thing is that we may only be seeing the tip of the iceberg," he concluded.