US Trade Tensions Lead to $240 Million Drop in Cryptocurrency Outflows: Investors Worry About Global Risks

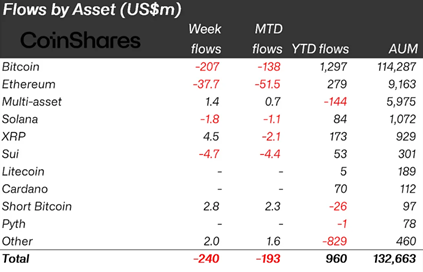

The cryptocurrency market witnessed a severe cash flow shock last week when the total capital outflow from digital investment products reached $240 million, marking a significant decline amid escalating trade tensions between the US and its global partners.

Fleeing money due to new US tax policy

According to a report by CoinShares, the cash outflow from cryptocurrency investment products has skyrocketed in the past week, mainly due to the impact of President Donald Trump's announcement of sweeping import tariffs to implement the "America First" policy. The escalation of protectionism has made investors worried about macro risks, especially the possibility of slowing global growth.

“The outflows may reflect investors’ response to new tariffs from the US, which threaten a stable global economic environment,” said James Butterfill, an analyst at CoinShares.

Bitcoin leads the outflows

Bitcoin (BTC) continued to be the focus of capital outflows, with $207 million withdrawn from related investment products, bringing net outflows year-to-date to $1.3 billion. Meanwhile, Ethereum (ETH) also recorded outflows of up to $37.7 million, followed by Sui (SUI) at $4.7 million and Solana (SOL) at $1.8 million.

Notably, the previous week saw positive inflows return to altcoins at $18 million, ending a four-week losing streak – but that trend quickly reversed.

The US accounts for the majority of global outflows

The data showed the US led the way with $210 million in outflows, bolstering the argument that President Trump’s new tariff policies were the main catalyst for investors to pull back.

The tariff plan announced includes:

- A 10% import tax on all goods, starting April 5.

- A “reciprocal” tax of 11% to 50% for countries with large trade surpluses with the US – officially effective April 9.

The hardest hit countries include China (taxes of up to 54%), the European Union (20%), Japan (24%), and Vietnam (46%). China has strongly protested, accusing the US of “unilateral protectionism and economic bullying.”

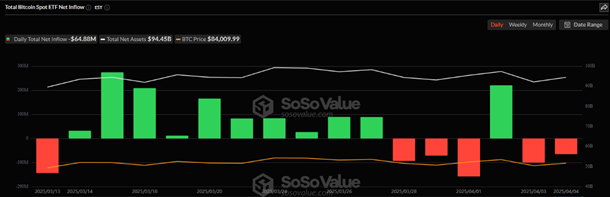

US Bitcoin ETFs: Biggest Outflows of the Month

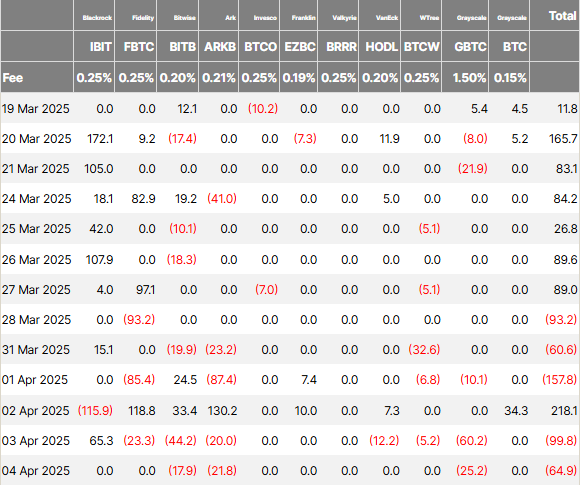

US spot Bitcoin ETFs were not spared either. Data from SoSoValue shows that $172.89 million was withdrawn from Bitcoin ETFs last week, ending a two-week streak of inflows totaling $941 million.

Notably, Grayscale’s GBTC led the way with $95.5 million in outflows, followed by WisdomTree’s BTCW ($44.6 million). Other notable funds such as IBIT (BlackRock), BITB (Bitwise), ARKB (ARK 21Shares), and HODL (VanEck) also recorded outflows ranging from $4.9 million to $35.5 million.

Despite a strong mid-week day with $220 million in inflows on April 3, it was not enough to offset the strong outflows in the remaining days, especially the $157.64 million withdrawn on Tuesday alone.

Ethereum ETFs Continue to Plunge, Few Bright Spots

Ethereum ETFs continued their six-week losing streak, bringing the total outflows to nearly $800 million since February. Last week alone, $49.93 million was withdrawn from Ethereum investment products.

However, there are still some bright spots. Funds such as EZBC (Franklin Templeton), FBTC (Fidelity), and the new Grayscale Bitcoin Trust attracted a total of $61.8 million in inflows, indicating that institutional investor selectivity is still present in the market.

The Outlook Ahead: Recovery or Structural Change?

According to CryptoQuant analyst Ki Young Ju, flow data should be evaluated in parallel with on-chain activity to better understand market supply and demand. He cautioned against looking solely at ETF indices and ignoring on-chain movements, especially when the majority of Bitcoin trading is still “on paper.”

Meanwhile, Standard Chartered predicts that Bitcoin could recover as early as this weekend. However, many investors are concerned that this pullback may not be a short-term correction, but rather the beginning of a restructuring of how institutions approach digital assets amid growing global uncertainty.