Trump Tariff War 2.0: How Could It Impact Bitcoin, Altcoins, and the Broader Market?

Financial and crypto markets are seeing similar developments to previous cycles, with analysts comparing the current macro situation to Trump’s previous trade war. Trade tensions and other macro factors are increasing volatility in the market, especially as focus turns to the US Dollar Index (DXY) and M2 money supply.

Bitcoin and Altcoins: A 2017-Style Bull Run Is Coming?

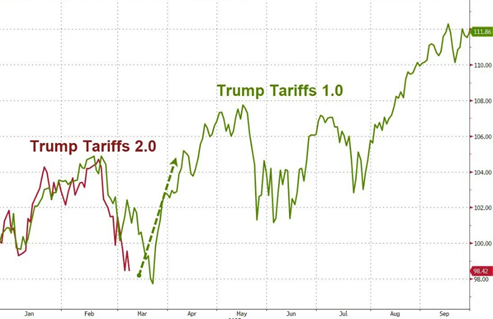

Recently, a chart from ZeroHedge showed a clear similarity between the DXY movement in 2025 and the DXY in 2016. This has attracted a lot of attention from crypto investors, suggesting a possible replay of the strong growth trends seen in the 2017 cycle.

Financial analysts, including The Kobeissi Letter, have highlighted the similarities between Trump’s tariff war 1.0 and the new tariff war in 2025. Despite the differences in current economic conditions, many technical indicators across asset classes such as gold, oil, stocks, and Bitcoin show similar trends.

Gold prices have increased by more than 10% this year, indicating investors are moving to safe-haven assets. Bitcoin, on the other hand, has fallen by nearly 10%, reflecting the split between risk appetite and market sentiment. On March 4, Bitcoin dropped more than $2,000 in just 25 minutes, approaching the $90,000 resistance level, highlighting the strong market volatility.

Long-term investors who used the Trump 1.0 trade war to buy in at low prices are hoping for similar opportunities in the current volatile period. Liquidity-driven moves and technical resistance levels continue to shape Bitcoin's price action.

"Altcoin Season" and "Trump Season"

Meanwhile, many analysts in the crypto space believe that "Altcoin Season" could emerge in tandem with "Trump Season." Investors like bitcoindata21 have pointed out that Bitcoin's price action in 2025 is drawing parallels to the 2017 bull run, reinforcing the view that an altcoin boom could be imminent.

Looking at historical trends, a strong Bitcoin market often leads to explosive growth in altcoins. As capital moves between cryptocurrencies, analysts say a new altcoin rally could resemble the 2017 cycle when Trump first took office.

In addition, other macroeconomic factors, such as the weakening of the US dollar, could also boost Bitcoin and alternative assets. With DXY falling below key support, investors are pouring capital into cryptocurrencies and gold to protect asset value.

The expansion of M2 money supply, another important indicator, has historically coincided with major Bitcoin price increases. Experts predict that liquidity conditions will improve by the end of March, leading to the possibility of Bitcoin entering a new bull cycle.

While macroeconomic uncertainty remains high, history has shown that strategic investors who capitalize on volatility have often reaped great success. If the 2017-2020 cycle repeats itself, Bitcoin and altcoins could see a strong rally in the coming months.

However, investors should be cautious, as short-term volatility remains a key feature of the current market.