Toobit Guide: Everything To Know About the Crypto Exchange in 2025

Toobit has already made quite a mark in the crypto space in its relatively short existence — especially as a key player in the crypto derivatives market. The exchange promises a blend of strong security, user-friendly trading features, and a unique branding approach centered around its “Hive” community and “Bee-Safe” security system. Its growing suite of products includes futures, spot trading, copy trading, and a Telegram Mini App with gamified rewards. This guide takes an objective look at Toobit’s strengths, challenges, and overall standing in 2025.

KEY TAKEAWAYS

➤ Toobit is a global crypto exchange offering 200+ spot trading pairs and 250+ futures contracts.

➤ The platform supports spot, futures, copy trading, trading bots, and fiat on-ramp services.

➤ Toobit provides 2FA, cold storage, Proof of Reserves, and flaunts an “A” rating from security audits.

➤ Toobit also has a staking program offering flexible and fixed earning options with competitive interest rates.

In this guide:

- Toobit in a nutshell

- Trading options on Toobit

- Toobit security features

- Automated trading tools on Toobit

- Toobit Earn: A staking platform to earn passive income

- Copy trading on Toobit

- Fees on Toobit

- Is Toobit worth considering in 2025?

- Frequently asked questions

Toobit in a nutshell

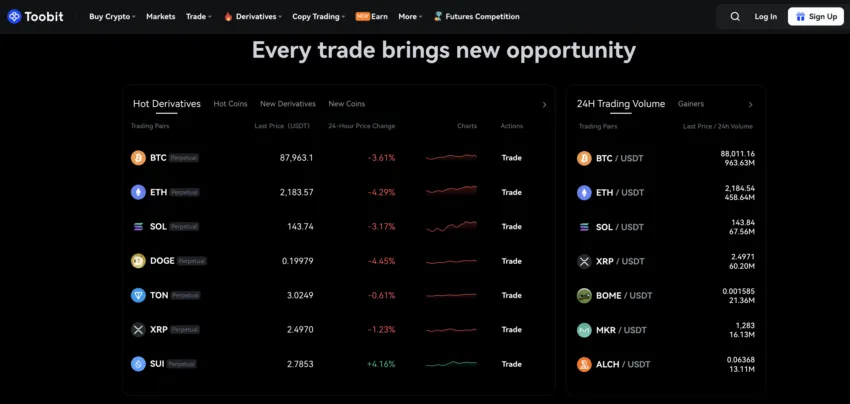

Interface: Toobit

Toobit is a centralized cryptocurrency exchange founded in late 2022. It operates as a global trading platform with a focus on accessibility, innovation, and financial security.

The exchange, headquartered in George Town, Cayman Islands, was founded by a team of industry veterans, including former executives from Huobi, Bybit, and Xiaomi. Their vision was to deliver a user-friendly and transparent trading experience to both retail and institutional traders.

The platform offers futures trading, spot trading, copy trading, and a fiat on-ramp for buying crypto with cards or P2P transactions.

Automated trading tools, such as grid bots and dollar-cost averaging (DCA) bots, help users optimize strategies, while a demo trading mode allows beginners to practice without financial risk.

Toobit’s ecosystem also includes a newly launched Telegram Mini App, which features a mini soccer game where players can earn trial funds.

As of March 2025, Toobit supports over 200 spot trading pairs and 250+ futures contracts. The exchange ranks 24th globally in derivatives trading with an approximate daily trade volume of $28 million, according to CoinMarketCap.

Now that you have a basic idea of the platform, let’s explore the key details driving its growth.

Toobit’s rapid growth and feature-rich platform have earned it industry accolades. In February 2025, Toobit was honored with two titles at the WeMoney Cryptocurrency Awards 2025 — Best New Cryptocurrency Exchange and Best for Derivatives.

Trading options on Toobit

Toobit provides a wide range of trading and investment products designed for different user needs. These include:

- Futures trading: The platform offers perpetual contracts with up to 100x leverage, which enables traders to amplify their positions. Toobit includes features like slippage protection to ensure fair trading for all users.

- Spot trading: It supports 200+ popular cryptocurrencies (BTC, ETH, USDT, and many others) on the spot market. Trades are executed with deep liquidity, meaning users can execute large trades with minimal slippage.

- Buy crypto (fiat on-ramp): Toobit also lets you make instant purchases of major coins (BTC, ETH, USDT, etc.) via multiple methods, including peer-to-peer (P2P) trading, existing crypto balances, or credit/debit cards.

- Copy trading: Toobit’s copy trading feature allows users to automatically replicate the trades of experienced top crypto traders with one click. Even newcomers can mirror successful strategies for opening and closing orders by following vetted professional traders.

- Demo trading: Features a risk-free demo environment where users can practice trading with real-time market data but no financial risk. This helps traders test strategies and gain confidence before moving to the live market.

Leverage on Toobit

Toobit has specific margin requirements in place to determine how much capital traders must commit to open and maintain leveraged positions. These requirements are divided into two key types:

➤ Initial margin: This is the minimum collateral required to open a leveraged trade. Higher leverage lowers the initial margin requirement, but it also increases risk exposure, as even small market movements can lead to liquidation.

➤ Maintenance margin: It is the minimum balance required to keep a position open. If the account balance drops below this threshold, traders face a margin call and must add funds to avoid forced liquidation.

Toobit provides high-leverage trading across multiple trading pairs, giving traders flexibility in their strategies:

➤ BTC/USDT – Up to 150x leverage

➤ ETH/USDT – Up to 125x leverage

➤ Other trading pairs – Leverage varies, typically ranging from 25x to 100x

Choosing between margin modes

Toobit offers two margin modes, each with its own merits in different risk management strategies:

➤ Isolated margin mode assigns a fixed margin to each individual trade. In this mode, losses are limited to the allocated margin only. This way, the platform ensures that other funds in the account remain unaffected.

➤ Cross-margin mode uses the entire account balance as collateral for all open positions. So, while this maximizes capital efficiency, it also increases risk since losses from one trade can impact others.

A word of caution

Margin trading offers the potential for higher returns, but it also amplifies risk. Even small market fluctuations can trigger liquidations and wipe out positions, leading to significant losses. Traders should use leverage cautiously, manage risk effectively, and never trade with funds they cannot afford to lose.

Toobit security features

Toobit promises to prioritize user security with multiple protective measures designed to protect accounts, assets, and personal data. Some of the notable security features on the platform include:

Account protection

All user accounts are secured with mandatory multi-factor authentication (2FA), which adds an extra layer of verification beyond passwords. This significantly reduces the risk of unauthorized access.

Industry-recognized security standards

Toobit has earned an “A” rating from independent security audit platforms, including cybersecurity ranking and certification platform CER.live and Hacken, a blockchain audit platform. The exchange claims zero incidents of asset loss due to hacking or security breaches since launch.

Cold storage and ongoing audits

Toobit assures that the majority of its customer assets are stored in offline cold wallets to minimize exposure to cyber threats. Toobit also conducts regular security audits to identify and resolve vulnerabilities, complemented by 24/7 system monitoring to enhance overall protection.

Encryption and privacy safeguards

Toobit says all sensitive user data on the platform is protected using AES-256 encryption to ensure personal information remains confidential and secure. The exchange also complies with global data protection regulations, demonstrating its commitment to privacy.

Advanced anti-phishing defenses

Toobit has several anti-phishing measures in place, including security updates, user education, and detection systems that identify and block fraudulent attempts. Suspicious activities are proactively flagged to prevent fraud and unauthorized access.

Proof of reserves for transparency

Toobit provides transparent Proof of Reserves, which can be used to verify that user assets are fully backed by reserves. This ensures funds remain secure and are never used without consent.

Automated trading tools on Toobit

Toobit provides traders with advanced automation tools to help them optimize strategies and minimize manual intervention. These include the Futures Grid Bot and the Futures DCA (Martingale) Bot — both accommodating different market conditions and risk preferences.

Futures Grid Bot: Best for capitalizing on fluctuations

The Futures Grid Bot allows traders to automate buying and selling within a predefined price range. It is ideal for sideways or range-bound markets.

The bot splits the selected price range into multiple levels, or “grids.” This way, it ensures systematic buying at lower prices and selling at higher prices to generate incremental profits. Its features include:

➤ Customizable price range: Users can define the upper and lower limits within which trades will be executed.

➤ Grid customization: Traders can set the number of grids, which determines the order spacing and frequency.

➤ Flexible leverage: Adjustable leverage options allow users to amplify potential returns, though higher leverage increases risk.

➤ Risk management: Integrated Take Profit (TP) and Stop Loss (SL) settings help manage gains and losses.

For instance, if Bitcoin is trading at $95,000, a trader using the Futures Grid Bot might place buy orders at $94,500 and $94,000 while setting sell orders at $95,500 and $96,000. This ensures that profit is captured as the price oscillates within the range.

Futures DCA Bot: Best for adaptive position sizing

The Futures DCA Bot, also known as the Martingale Bot, follows a progressive investment strategy where position sizes increase after a losing trade. The goal is to recover losses more quickly when the market moves favorably. Its key features are:

➤ Adaptive position sizing: The bot doubles the investment amount after each loss, thereby increasing potential recovery.

➤ Cycle-based management: The strategy resets once a profitable trade is made, followed by the start of a new cycle.

➤ Controlled risk: Users can define maximum position sizes, TP, and SL levels to prevent excessive losses.

For example, if a trader starts with $100 on a BTC trade and incurs a loss, the bot will place a $200 order on the next cycle, followed by $400 if the loss continues. This pattern continues until either a winning trade offsets prior losses or the stop-loss threshold is hit.

Toobit Earn: A staking platform to earn passive income

Toobit launched a new staking and passive income platform in January 2025. Dubbed Toobit Earn, this addition expands the exchange’s offerings and gives users more ways to generate returns on their assets.

The initial rollout featured an exclusive seven-day USDT staking product with a 100% APR (annualized percentage rate). Traders could deposit as little as 1 USDT, with a cap of 500 USDT per user, into a dedicated pool limited to 250,000 USDT in total. This high short-term APR aimed to attract users and demonstrate the platform’s earning potential.

Toobit Earn is designed for traders of all experience levels. Beginners can access a straightforward entry point into crypto investing, while more experienced users can explore additional earning opportunities.

Toobit plans on building on this initial success to expand Earn with more products in future phases. For instance, two new offerings — Flexible Earning and Fixed Earning — will provide users with custom options.

Flexible Earning allows withdrawals at any time with dynamic interest rates, while Fixed Earning offers higher returns in exchange for locking assets for a set period. These choices allow users to balance liquidity and yield according to their investment strategy and risk tolerance.

And it’s not just USDT — Toobit Earn will also support a wide range of cryptocurrencies so users get more opportunities to earn competitive interest on their holdings.

Toobit Earn also encompasses recent additions like the Telegram Mini App, which allows users to trade directly within Telegram’s chat interface.

Additionally, the mini-app also introduces Toobit Football. In this gamified experience, players take on the role of a soccer superstar, dodging tackles and collecting power-ups to earn game coins. These coins determine leaderboard rankings and may qualify players for future airdrops.

Copy trading on Toobit

Some of the top traders you can copy: Toobit

Toobit’s copy trading feature simplifies trading for users by replicating the trading strategies of seasoned professionals. This removes the need to constantly monitor market movements, making the experience more efficient and accessible to all.

How it works

Users can select from a curated list of top-performing traders, known as Pro Traders, to follow. Users can view their trading history and performance metrics, and select the one that best fits their investment goals.

Once chosen, the system mirrors their trades directly into the user’s account, ensuring they benefit from expert strategies without the need for active management.

Key features

- Zero-slippage copy trading: Toobit’s advanced matching engine ensures price synchronization between followers and Pro Traders.

- Pro trader Analysis: This tool offers a comprehensive view of a trader’s performance by visualizing key metrics such as ROI% and earnings over a fixed period, aiding users in making informed decisions when selecting a Pro Trader to follow.

- Signal cloning: All users, including non-Pro Traders, can share their trading signals for contract pairs. Community members can then decide whether to replicate these signals by setting their own trading parameters.

Benefits

- Access to professional strategies: Perfect for even beginners, traders can leverage the expertise of successful traders without extensive market knowledge.

- Flexible control: Followers can adjust, pause, or stop copying trades at any time to align with their risk preferences.

Experienced traders can also join as Pro Traders, allowing others to follow their strategies while earning 15% of their followers’ profits. This allows them to create an additional revenue stream for themselves, while building a reputation in the crypto trading community.

Fees on Toobit

Toobit’s trading fees are tiered based on your 30-day trading volume and account balance. As you increase your trading activity or maintain higher account balances, you start benefiting from lower fees.

➤ Like most exchanges, Toobit also differentiates between Maker orders, which add liquidity to the market, and Taker orders, which remove liquidity. The maker fee is generally lower than the taker fee.

| VIP level | Balance (USDT) | 30-day futures volume (USDT) | 30-day spot volume (USDT) | Futures maker fee | Futures taker fee | Spot maker fee | Spot taker fee |

| VIP0 | <50,000 | <10,000,000 | <100,000 | 0.0200% | 0.0600% | 0.0750% | 0.1000% |

| VIP1 | ≥50,000 | ≥10,000,000 | ≥100,000 | 0.0200% | 0.0500% | 0.0700% | 0.0900% |

| VIP2 | ≥100,000 | ≥30,000,000 | ≥500,000 | 0.0140% | 0.0400% | 0.0600% | 0.0800% |

| VIP3 | – | ≥50,000,000 | ≥1,000,000 | 0.0120% | 0.0375% | 0.0350% | 0.0600% |

| VIP4 | – | ≥100,000,000 | ≥5,000,000 | 0.0100% | 0.0350% | 0.0200% | 0.0500% |

| VIP5 | – | ≥500,000,000* | ≥20,000,000 | 0.0080% | 0.0315% | 0.0150% | 0.0450% |

| VIP6 | – | ≥800,000,000* | ≥30,000,000* | 0.0060% | 0.0300% | 0.0125% | 0.0375% |

Note that API trading volume must be ≤20% for VIP5 and VIP6 levels.

Meanwhile, withdrawal fees on Toobit are dynamic and adjust automatically based on current market conditions.

Pros and cons

While Toobit performs well across most key metrics — and even surpasses expectations in some areas — it has its limitations, like any other exchange, regardless of size. Some of its advantages and drawbacks include:

| Pros | Cons |

| Multiple trading options including futures, spot trading, copy trading, and automated trading bots. | Lacks strong regulatory licensing in major jurisdictions like the U.S. and Europe. |

| A wide range of assets available on the platform | The default taker fee (0.06% for futures, 0.10% for spots) is slightly higher than some competitors until users reach higher VIP tiers. |

| With a tiered VIP system, high-volume traders benefit from reduced maker and taker fees. | Relatively new compared to established exchanges, which may raise concerns for some new users. |

| The Bee-Safe security system includes multi-factor authentication (2FA), cold storage for assets, and anti-phishing measures. | |

| Received an “A” security rating from CER.live and Hacken | |

| Users can verify that their assets are fully backed, which reduces concerns over liquidity risks. | |

| Winner of Best New Cryptocurrency Exchange and Best for Derivatives at the 2025 WeMoney Cryptocurrency Awards | |

| Tntegrates gamification, such as the Telegram mini app with soccer-themed rewards, |

Is Toobit worth considering in 2025?

As of 2025, Toobit has demonstrated impressive performance across almost all key metrics. Couple that with the generally positive feedback it has gathered from the community, the exchange appears to be on a steady growth trajectory. On that count, it stands as a viable option (so far) whether you are new to crypto or considering a switch.

That said, as with any investment decision, choosing the right exchange also requires careful consideration. In most cases, the best way to gauge its suitability is to try it yourself. Fortunately, Toobit offers a demo account so you can explore its features risk-free before committing real funds. Always do your own research (DYOR) and never invest more than you can afford to lose.

Frequently asked questions

Is Toobit a safe exchange?

What trading options are available on Toobit?

How much does Toobit charge in trading fees?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.