Three Bitcoin Price Scenarios for 2025: Can BTC Hit $175,000?

The cryptocurrency market is at a crossroads as Bitcoin enters the second quarter of 2025 with mixed but promising signals. Based on technical analysis and on-chain data, three main scenarios have been outlined for the upcoming direction of BTC, with the most optimistic scenario predicting a sharp increase to $175,000.

Institutional and Policy Driven

According to analysts, a series of factors are converging to create a foundation for a new bull run. Most notably, institutional capital continues to pour into the market and investor sentiment is positive following the Trump administration’s proposal to establish a national Bitcoin reserve as part of a new financial strategy.

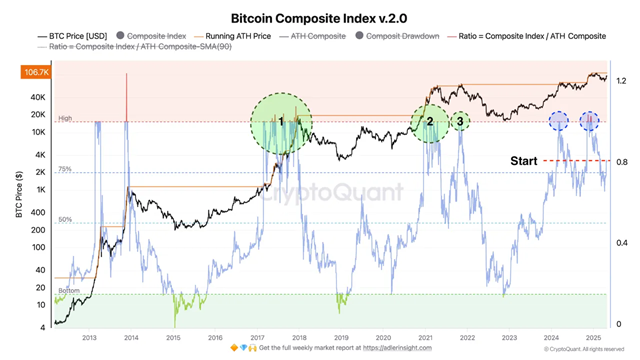

In addition, market indicators are recording positive signals. Data from AxelAdlerJr shows that the Bitcoin Composite Index has hit 0.8 — marking the beginning of a new bull cycle, similar to 2017 and 2021.

Three BTC Price Scenarios for 2025

AxelAdlerJr’s analysis suggests three main directions for Bitcoin price development in the next 12 months:

Bullish Scenario: If the Bitcoin Composite Index breaks above 1.0, BTC could peak in the $150,000–$175,000 range. This would mark a strong bull cycle fueled by high liquidity and positive sentiment.

Accumulation Scenario: If the index fluctuates between 0.8–1.0, BTC price is likely to accumulate in the $90,000–$110,000 range. Investors hold their current positions without significantly increasing their market exposure.

Correction scenario: In case the index drops below 0.75, BTC could correct to the $70,000–$85,000 range due to profit-taking by short-term investors. However, this is considered the least likely scenario.

Positive signs from on-chain data

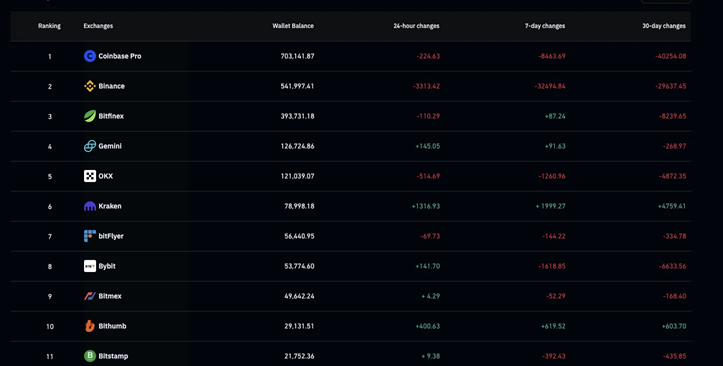

According to Coinglass, more than 42,500 BTC were withdrawn from centralized exchanges over the past week, reducing the supply on exchanges to just 2.48 million BTC – a 7-year low. This move is seen as a clear sign of accumulation and reduced selling pressure.

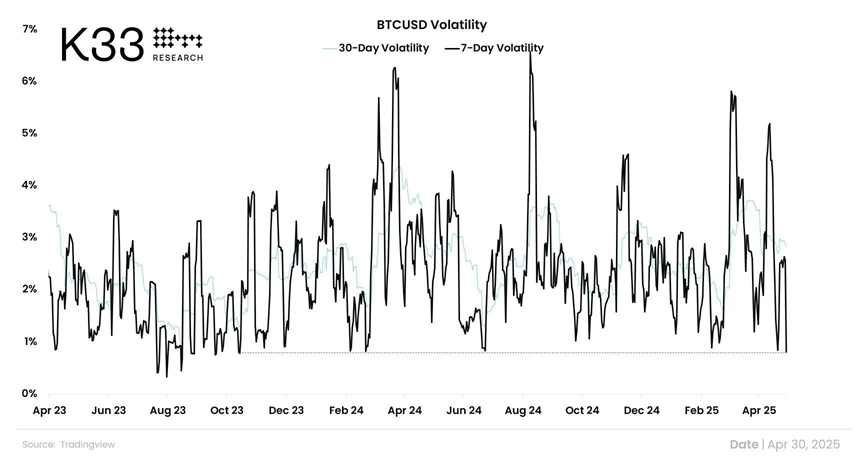

In addition, Bitcoin's 7-day price volatility is at its lowest since late 2022, a technical signal that often suggests that the market is about to enter a breakout phase.

Support Levels and Technical Analysis

Technical analyst Ali identified key support levels at $93,198 and $83,444. Holding above these levels would solidify the uptrend and open up the possibility of reaching the $150,000 target.

Similarly bullish, analyst Breedlove22 also pointed out three key indicators that are strengthening Bitcoin’s bullish outlook:

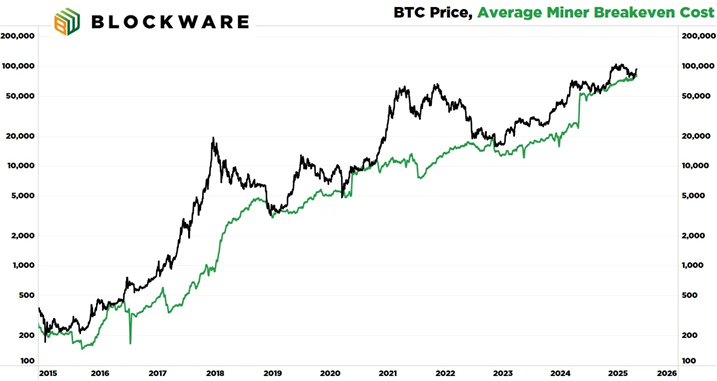

1. The average cost of production for miners is at a low – which is often a signal of the start of a bull run.

2. The supply held by long-term investors has increased by 150,000 BTC over the past month.

3. Global and USD liquidity is expanding, facilitating new capital inflows into the digital asset market.

In addition, the Bitcoin network hash rate – a measure of computing power – is also maintaining high levels, indicating confidence and sustained investment from miners.

Conclusion

While Bitcoin’s long-term outlook for 2025 is tilted to the upside, investors should still be prepared for short-term volatility. With a solid foundation from technical data and market sentiment, a target of $150,000–$175,000 is possible, but caution and risk management are still required in a volatile market environment.