The Future of Crypto Wallets Depends on User Experience and Security, Trust Wallet Says

The rise in global digital asset adoption is expected to drive the growth of crypto wallets in the coming years. To prepare for this trend, developers are focusing on enhancing security and expanding the functionality of crypto wallets.

BeInCrypto spoke with the Trust Wallet team to discuss the future of crypto wallets, their utility, and the challenges that need to be overcome to drive mass adoption.

Crypto Wallet Adoption Expected to Surge

The crypto industry has grown significantly in recent years, as evidenced by the rise in the number of people owning digital assets. According to Triple-A's 2024 report, there are now 562 million people globally who own at least one cryptocurrency, up 6.8% from the previous year.

As cryptocurrencies become more popular and accepted by mainstream financial institutions, the role of crypto wallets becomes increasingly important. These wallets not only help users manage and securely store their digital assets, but also ensure access to their assets.

Despite the decline in crypto wallet usage in 2022 due to the crypto winter and the collapse of FTX, researchers expect the crypto wallet market to grow strongly in the future.

According to forecasts, the global crypto wallet market will be worth around $3.22 billion in 2024 and is expected to reach $33.67 billion in 2033, with an annual growth rate of 29.81%. This increase is mainly driven by the acceptance of cryptocurrencies as a legitimate asset class.

The adoption of Bitcoin and Ethereum by financial institutions, especially through ETFs in the United States, also marks a major milestone in the development of cryptocurrencies.

2025 is seeing increased competition in the crypto wallet market, with developers focusing on improving security technology and software to meet new demands.

Integrating Crypto Wallets into the FinTech Ecosystem

Pierre Lavarague, Head of Business Development at Trust Wallet, is optimistic about the future of crypto wallets. He believes that integration with traditional financial markets will be a key factor in their success.

Lavarague believes that in the next three to five years, crypto wallets need to become part of the broader FinTech ecosystem, surpassing the current category of crypto wallets to become a mainstream financial solution for the masses.

Providing a seamless and simple user experience will be key to achieving this goal. This means that users will be able to interact with financial services on the blockchain without even knowing they are using blockchain technology.

However, to achieve this, crypto wallets need to solve one of the biggest challenges today - onboarding new users into the ecosystem.

Onboarding new users

One of the biggest barriers today for crypto wallets is how to onboard new users into the world of crypto, DeFi or Web3. Lavarague explains that for users without deep technical knowledge, accessing and using a crypto wallet can be a major challenge.

He believes that the user experience needs to be optimized and easy to help new users easily get acquainted with the functions of a crypto wallet, thereby promoting wider adoption.

Artificial Intelligence (AI) Powers the User Onboarding Process

Lavarague believes that AI can play a key role in personalizing the crypto wallet user experience. By using user data, AI can create customized experiences based on on-chain actions, personal preferences, and data provided by users.

He envisions that in the future, each user could have a different experience when using a crypto wallet, based on their needs and preferences, from trading tokens to NFTs or yield mining.

In addition to improving the user experience, AI can also protect crypto wallets from increasingly sophisticated cyberattacks.

Protecting Against Cyberattacks

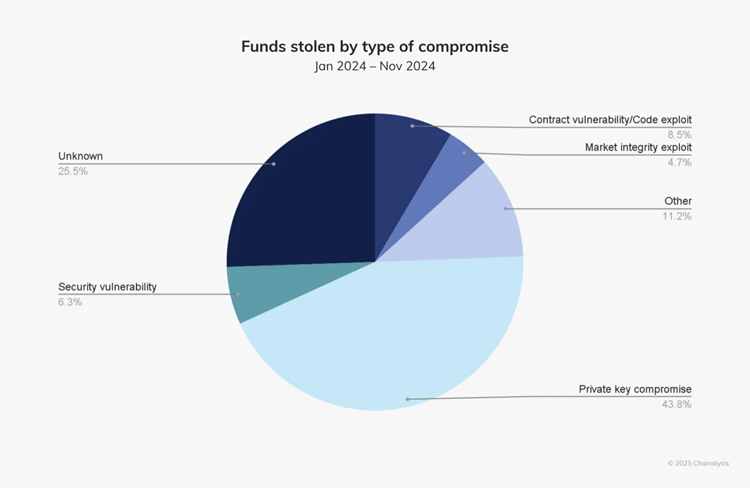

Security has always been a top concern for crypto wallet developers. According to Chainalysis’ 2025 report, private key compromise will be the leading cause of cryptocurrency theft by 2024, with the total amount stolen reaching $2.2 billion

Eve Lam, Chief Information Security Officer at Trust Wallet, said that wallet developers are integrating advanced technologies such as AI to detect vulnerabilities in smart contracts and blockchain systems. This helps detect potential issues early before they become serious threats.

AI also helps improve the ability to monitor and recover stolen assets. Advanced forensic tools can track the movement of stolen assets on the blockchain, improving the likelihood of recovery and creating a higher barrier to entry for