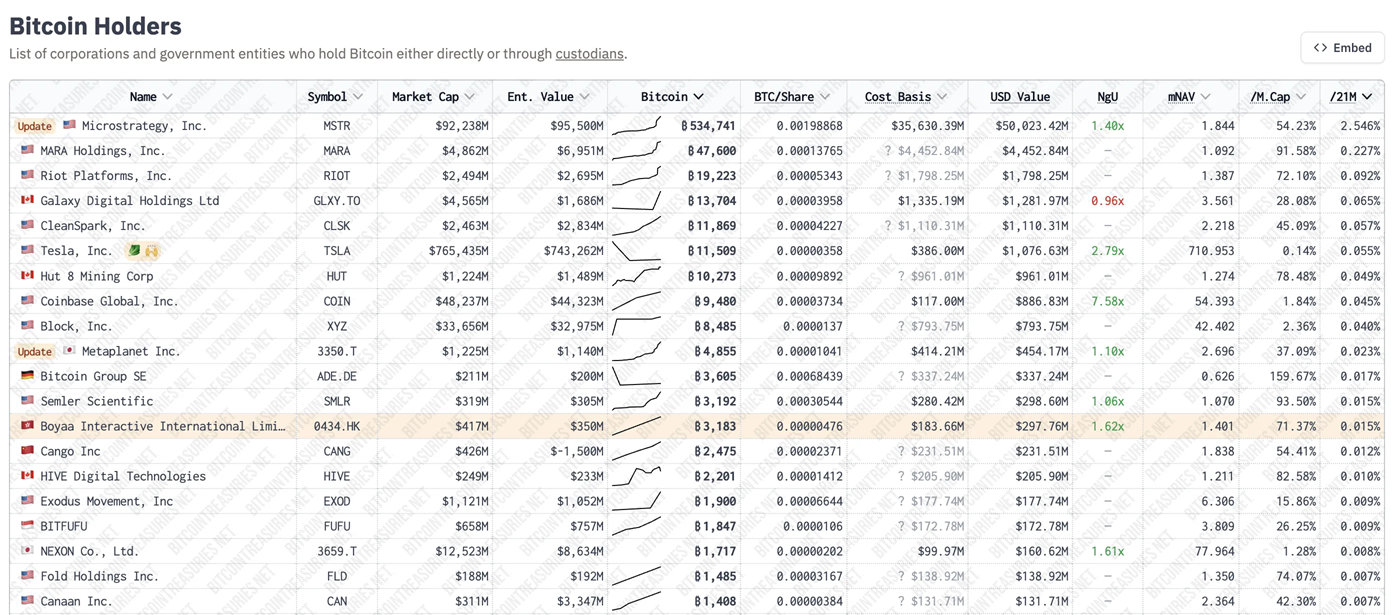

Tesla Holds 11,509 BTC Worth Over $1 Billion Despite Q1 Revenue Decline

Despite missing its Q1 2025 revenue expectations, Tesla continues to hold on to its Bitcoin portfolio with 11,509 BTC — now worth over $1 billion after Bitcoin’s price rebounded above $93,000.

Revenues Fall, Bitcoin Still a Long-Term Strategy

According to Tesla’s April 22 filing with the US Securities and Exchange Commission (SEC), Q1 revenue was just $19.34 billion, lower than analysts’ expectations of $21.37 billion. Electric vehicle sales, Tesla’s mainstay, fell sharply by 20% year-over-year due to a 13% drop in deliveries and a 16% drop in production.

However, despite the adverse factors and a stock price that has plunged more than 40% since the beginning of the year, the company has not sold any Bitcoin this quarter. As of the end of March 2025, Tesla's BTC holdings remained at 11,509 BTC, equivalent to about $951 million at that time. With the latest price increase, the current value has surpassed the $1 billion mark.

Bitcoin - a strategic reserve asset

New regulations from the Financial Accounting Standards Board (FASB) require companies like Tesla to revalue digital assets at market value every quarter. This is a major change from the past, when only depreciation was recorded. In Q4 2024, Tesla reported a profit of more than $600 million thanks to the sharp increase in Bitcoin prices.

The lack of any transactions this quarter shows that Tesla remains committed to its long-term holding strategy. The company sees Bitcoin as part of its strategic portfolio, similar to the approach taken by MicroStrategy and Metaplanet – two of the most prominent organizations with strong “HODL” policies.

Elon Musk and the question of the future of Bitcoin strategy

In addition, founder Elon Musk is also planning to refocus on Tesla in the near future, after a period of sharing interest in DOGE and side projects. “Not leaving, just allocating time more reasonably when DOGE has stabilized,” Musk wrote on social media.

In the context of market volatility, especially inflationary pressure and unclear trade policies, analysts such as Dan Ives of Wedbush warn that Tesla is facing a “code red situation”. Musk’s consideration of restructuring his financial strategy, including his Bitcoin portfolio, is a big unknown.

However, according to analysis from BeInCrypto, the cryptocurrency market may start to stabilize from mid-Q2, with strong growth momentum returning in Q3 thanks to the positive impact after the halving and a clear trend from institutional investors. With confidence in Bitcoin still intact, Tesla may continue to be one of the pioneers in holding digital assets on its corporate balance sheet.