Q2 2025: A “Golden” Opportunity to Accumulate Altcoins When the Market Bottoms?

As Bitcoin (BTC) continues to lead the market with an increasing dominance rate, many analysts believe that Q2 2025 is opening up a rare opportunity to accumulate altcoins – a group of digital assets that are severely undervalued compared to their previous peaks.

Altcoins Bottom – A Signal for a New Bull Season?

The altcoin market capitalization has now fallen more than 40% from its all-time high (ATH), falling below the $1 trillion threshold. This has left many investors in a state of loss, but according to experts, this could be a “spring compression” phase, preparing for a new altcoin boom.

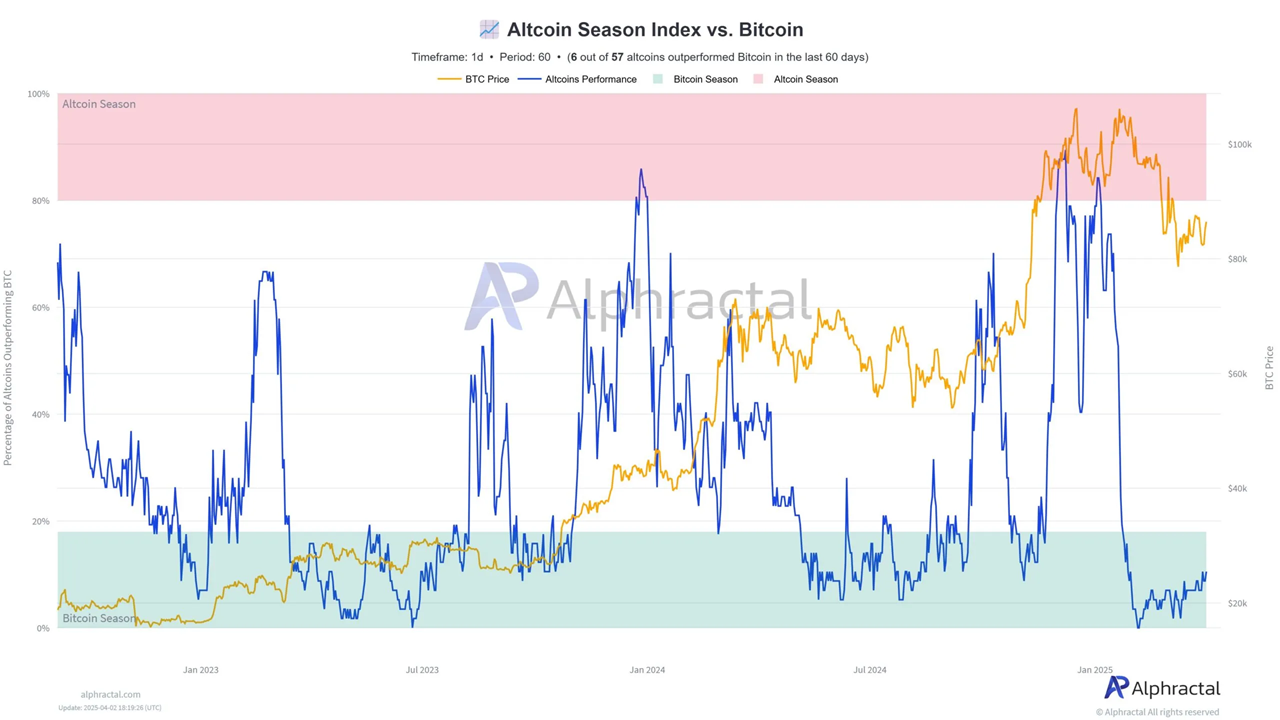

Joao Wedson, founder of Alphractal, shared on the X platform that most altcoins have fallen back to their starting prices, especially projects that were hyped with the slogan “fly to the moon”. For Wedson, this is a clear sign that the market is accumulating – and that it is the time to buy at a low price.

“We have been in a bear market since December 2024, and the sentiment has been negative since October. But I believe that from April to May, the market will heat up again – although BTC may continue to correct,” Joao Wedson predicted.

Wedson recommends that investors focus on altcoins with solid fundamentals and long-term potential. Conversely, he warned to stay away from coins that have been hot in 2024 such as ETH, SOL or TRX. His suggested strategy is to “wait patiently and collect low prices” – a cautious approach that could yield big rewards.

Bitcoin Dominance and Altcoin Undercurrents

Another prominent analyst – Ash Crypto – has a similar view. According to him, when Bitcoin Dominance reaches 70%, it is often a signal that Bitcoin is entering a cycle peak, and the market is about to enter an “altcoin season”.

Currently, the BTC.D index remains above 60% with no signs of weakening. History shows that after BTC reaches a dominance peak, capital tends to flow into altcoins, ushering in a strong rally.

“Altcoin season is forming – just like what we saw in 2021. The next 3 to 6 months could shape your entire portfolio.” – Merlijn The Trader shares.

Market sentiment is still fearful

However, not everyone is optimistic. A recent report from BeInCrypto said that the Fear and Greed Index in the cryptocurrency market has dropped to just 25 points – the “Extreme Fear” zone. The cause is said to come from geopolitical uncertainties, concerns about global trade tensions and the trend of capital withdrawal from risky assets.

Nic Puckrin – founder of Coin Bureau – believes that although Bitcoin still has a lot of room for growth, not all altcoins can survive this correction period. Careful selection will be the deciding factor between making a profit or taking a loss.

Conclusion: With a combination of technical and psychological factors, Q2/2025 is considered by many experts to be the key time for a new “altcoin season”. However, as with any sensitive market phase, a smart and disciplined investment strategy is still vital to take advantage of opportunities and avoid risks.

If you want me to add more charts, name some potential altcoins, or create a shortened version for social media, I can support you further!