Public Companies Suffer Massive Losses as Bitcoin Plunges Below $80,000

The cryptocurrency market continues to experience a sharp decline, leaving many public companies investing in Bitcoin with significant losses. As BTC prices plunge below $80,000, the strategy of holding Bitcoin as a reserve asset is becoming a double-edged sword for many businesses.

Unrealized Losses Soar, Market Witnesses “Black Monday”

Starting the new week with a market shock, Bitcoin prices dropped 9.6% in 24 hours, hitting a low of $75,089 – according to data from BeInCrypto. This free fall has led the community to call it the “Black Monday” of crypto.

The drop was followed by a massive wave of liquidations. According to data from Coinglass, the total value of liquidations in this time frame reached $474 million, of which more than $405 million were “burned” buy orders. This further exacerbated the losses of companies holding large amounts of Bitcoin on their balance sheets.

Many big players are regretting their losses

Data from Bitcoin Treasuries shows that the NGU index – reflecting the difference between the current market value and the cost of buying – is turning red for many large organizations.

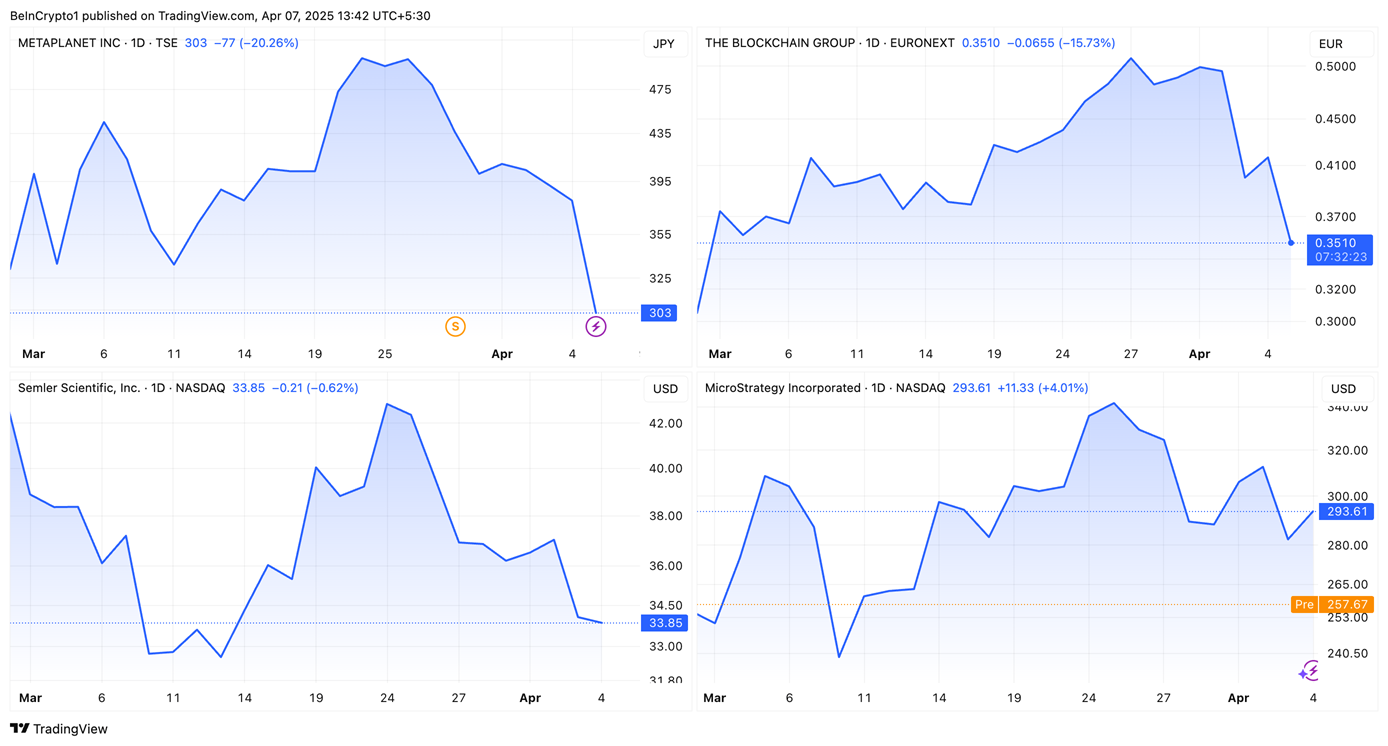

Metaplanet (3350.T) currently records an unrealized loss of 12.4% on its total holdings of 4,206 BTC, equivalent to more than $314 million, with an average purchase price of $85,483/BTC.

The Blockchain Group (ALTBG.PA) did not fare much better, with a loss of up to 14.4% on 620 BTC, worth about $46.39 million. The average price paid by this company is $87,424 per Bitcoin.

Similarly, Semler Scientific (SMLR) is also “taking the hit” as its 3,192 BTC portfolio, worth nearly $239 million, is currently negative 14.7%. The average purchase price is $87,850.

Even MicroStrategy (MSTR), the pioneer of the wave of corporate Bitcoin investments, is not immune to the pressure. While it is still profitable overall thanks to early accumulation with an average price of $67,485/BTC, all of its BTC purchases since November 2024 – at prices ranging from $83,000 to $106,000 – are in a loss.

Company Stocks “Retreat” Along With Bitcoin

Bitcoin’s plunge has quickly affected the stock prices of related companies. 3350.T shares fell as much as 20.2%, ALTBG.PA lost 15.8%, while MSTR fell 11.2% in pre-market trading. SMLR only fell slightly by 0.6%, but also showed the general concern from investors.

Peter Schiff continues to criticize, predicts "bad scenario" for MSTR

Economist Peter Schiff - famous for his Bitcoin skepticism - did not miss the opportunity to attack MicroStrategy. On the X platform, he posted:

"Hey Saylor, if you don't want Bitcoin to fall below the average of $ 68,000, you better borrow more money and buy today."

Schiff also warned that MicroStrategy's Bitcoin investment strategy could lead to bankruptcy and asserted that BTC does not qualify as a safe haven asset in the crisis, due to its extreme volatility compared to gold and other traditional assets.

A wake-up call for companies that are “holding” Bitcoin

This event once again raises a big question mark about using Bitcoin as a corporate reserve asset. While some companies like MSTR are still making overall profits thanks to low capital costs, a series of other organizations are “sitting on fire” as BTC prices continue to fluctuate erratically.

Is the trend of investing in Bitcoin by businesses still a sustainable long-term strategy? Or will this be a painful lesson when the market turns around?

The answer will depend largely on the developments of the cryptocurrency market in the coming time - where trust and risk always go hand in hand.