Over $3 Billion in Bitcoin and Ethereum Options Expire Ahead of Trump’s Crypto Summit

Over $3 billion in Bitcoin and Ethereum options expire today, including $2.5 billion in BTC and nearly $500 million in ETH contracts. How will this affect the prices of the two assets?

The options expiration is set for 8:00 UTC on Deribit, potentially causing major volatility in the crypto market.

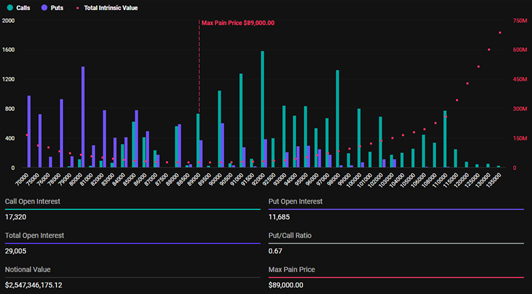

Bitcoin Faces Maximum Pain Threshold at $89,000

On March 7, 29,005 Bitcoin contracts with a notional value of $2.54 billion are set to expire. Data from Deribit shows that Bitcoin’s put-to-call ratio is 0.67. The maximum pain threshold, the price at which investors holding the contracts will suffer the most damage, is $89,000.

Bitcoin Options Expiration

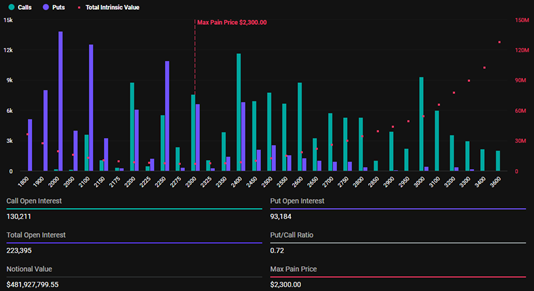

In addition, Ethereum also saw the expiration of 223,395 contracts, worth $481.9 million in notional value. The maximum pain threshold for Ethereum was $2,300, with a put/call ratio of 0.72.

Max Pain Threshold and Market Sentiment

The maximum pain threshold in the crypto options market represents the most financially uncomfortable price level for option holders. Meanwhile, the put/call ratio below 1 for both Bitcoin and Ethereum suggests that call options are preferred.

Greeks.live, an options trading analysis tool, provided further insight into the market situation. According to them, the general sentiment is currently bearish, with frustration over volatility and volatile price action.

“Bitcoin’s large intraday swings, such as the recent surge to $6,000, have created what we call a ‘two-way trap’ condition,” Greeks.live said. This makes it difficult for traders to identify a clear trend.

The majority of traders are eyeing key resistance in the $87,000-89,000 range, with $82,000 being noted as the recent bottom. However, there is still a split on whether a sustainable bottom has been formed.

Traders’ Strategies Ahead of Volatility

The pronounced sell bias reflects bearish sentiment, as traders continue to hedge short positions despite some short-term upside moves. Some traders have adjusted their strategies to accommodate the high volatility.

Some are selling calls in the $89,000-$90,000 range as a preferred strategy. One trader reported hitting a -260% gain on calls purchased at lower levels.

Liquidity and investor caution

Caution is heightened as the market is in a period of thin liquidity, leading traders to enter and exit quickly to minimize risk. External macro factors, such as trade policy and tariff announcements, also add to the uncertainty.

Many traders have chosen to stay on the sidelines and wait for clearer signals before continuing to open new positions. Deribit asked: "With the market as tense as it is, do you think the price will continue to break through or stop at the maximum pain level?"

Short-Term Price Impacts

However, investors should note that options expirations may only have a short-term impact on the price of the underlying asset. The market may quickly stabilize and correct any excessive price movements afterward.

These developments come on the heels of President Donald Trump signing the Strategic Bitcoin Reserve Executive Order, a significant step, although many details remain to be worked out at the upcoming White House crypto summit.