Over $2 Billion in Bitcoin and Ethereum Options Expire After FOMC Minutes and Digital Asset Summit

After the Federal Open Market Committee (FOMC) minutes and digital asset summit held on Wednesday and Thursday, approximately $2.09 billion in Bitcoin (BTC) and Ethereum (ETH) options are set to expire today. The expiration of these options could cause market volatility, with investors keeping a close eye on any potential changes.

Over $2 Billion in Options Expires Today

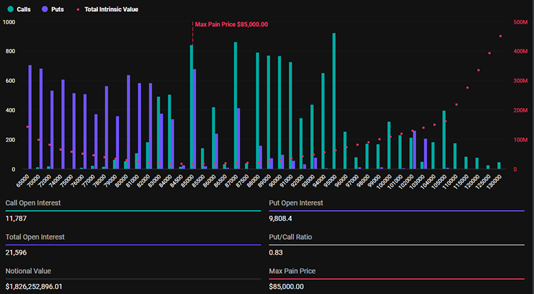

According to Deribit, a total of $1.826 billion in Bitcoin options are set to expire today, with the maximum pain point of these contracts at $85,000.

The total number of Bitcoin options contracts is 21,596, down from 35,176 contracts last week. Despite the recent volatility, the put-to-call ratio is 0.83, indicating that the overall market sentiment remains bullish.

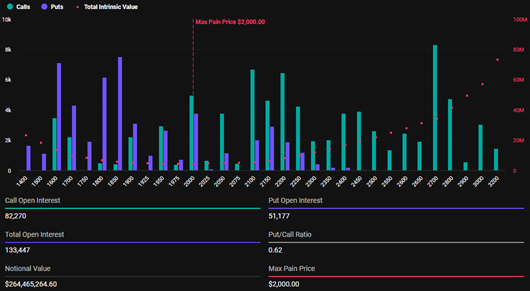

Meanwhile, Ethereum has $264.46 million worth of options expiring, with 133,447 contracts outstanding. This is also down from 223,395 contracts from last week. The maximum pain point for Ethereum options is $2,000, and the put-to-call ratio is 0.62, indicating a slight bias to the upside.

Bitcoin and Ethereum Options Expiration

As the options approach their expiration date at 8:00 UTC today, the prices of Bitcoin and Ethereum have been trending toward their respective maximum pain points. Data from BeInCrypto shows that BTC is currently trading at $84,414, while ETH is trading at $1,977.

This modest price increase is said to be in line with the strategy of smart money traders in the options market, as they push prices closer to the maximum pain level, where the highest number of contracts expire worthless. This leads to a temporary stabilization before the market continues to correct.

Market reaction ahead of options expiry

The put-to-call ratio of both Bitcoin and Ethereum is currently below 1, indicating that calls are dominating puts. This reflects the bullish market sentiment, despite some short-term volatility due to external factors.

A group of analysts from crypto options trading tool Greeks.live opined that the market is divided. Some traders predict that prices could fall after the FOMC meeting as policymakers do not offer further rate cuts, disappointing the crypto market.

However, others expect a temporary rally before the market enters a volatile phase. Bitcoin’s $83,000 to $85,000 range and Ethereum’s $1,950 to $2,000 range are key areas to watch, with potential volatility based on political developments and strategic purchases from large institutions.

Analysts’ Forecast

Analysts at Greeks.live expect prices to fall before rebounding next week. While the current rally is possible, it is not considered sustainable. Bitget CEO Gracy Chen remains optimistic, saying that Bitcoin will hold above the $73,000 to $78,000 range, opening up the potential for a larger rally in the future.

However, even with positive expectations, traders and investors need to be prepared for short-term volatility. Historically, options expirations have often led to temporary price fluctuations, but the market has generally stabilized shortly thereafter.

Therefore, monitoring technical indicators and market sentiment is important to effectively manage risk during this sensitive period.