Murad's Meme Coin Portfolio Loses $45 Million as Market Crashes

The meteoric rise and subsequent crash of the meme coin market has left even its staunchest advocates like Murad vulnerable to severe losses.

The negative sentiment has not only affected meme coins but has also spread to the entire cryptocurrency market, including Bitcoin (BTC), which is currently experiencing a sharp downturn.

Murad Takes Huge Losses From Meme Coin Portfolio

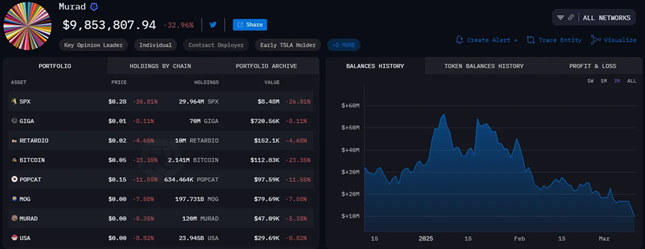

Murad, who calls himself "Meme Coin Jesus," has seen his portfolio fall by more than 82% in just two weeks. He was previously worth $55 million, but data from Arkham Intelligence shows that figure has now dropped below $10 million.

“It’s terrifying to hold generational wealth in scam coins and end up with zero dollars,” crypto analyst The Martini Guy quipped.

That represents a massive loss of $45 million, highlighting the risks of long-term investment in meme coins.

Murad’s portfolio Murad’s portfolio. Source: Arkham

This reflects the sentiment of many traders caught up in the recent meme coin craze. As the market enters a bear market, meme coins are posting big losses. Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), and TrumpCoin (TRUMP), the top four meme coins, are down around 7% as of press time.

Murad’s meme coin picks are also plummeting in value, down nearly 84% since their January peak of $4.8 billion, according to data from CoinGecko.

Murad’s meme coin picksMurad’s meme coin picks. Source: CoinGecko

Despite the market downturn, Murad remains confident about the market’s recovery, reassuring his Twitter followers.

“The bounce backs will be glorious,” Murad declared.

However, many remain skeptical about the meme coin market’s quick recovery as the sector has experienced a major downturn. The collapse has been exacerbated by the increased scrutiny that influencer-promoted meme coins face.

Recent research has found that more than 76% of influencer-promoted tokens fail to deliver real-world value. Many of these tokens experienced short-term growth spurts fueled by hype before eventually fading, resulting in significant losses for investors. These findings further highlight the risks of pursuing speculative investments based on social media hype without due diligence.

BeInCrypto also reported that 97% of meme coins ultimately failed, with only 15 of the 1.7 million coins achieving sustained success. Factors leading to failure may include lack of real-world utility and poor project management.

Amid Murad’s heavy losses, blockchain intelligence platform Arkham is ramping up pressure on crypto influencers and meme coin promoters. The platform recently launched a new tracking feature to monitor the on-chain activities of crypto influencers.

“Influencers with over 100k Twitter/X followers are now tagged on Arkham with the label: Key Opinion Leader,” Arkham announced.

This development could make things difficult for popular figures who profit from hyping low-quality tokens. With Arkham’s new tool, investors can track wallet movements and see if these influencers are holding or dumping the assets they promote. This could expose fraudulent behavior by some influencers.

Still, Murad’s losses should serve as a cautionary tale for traders who rely on meme coins. According to recent reports, this trend suggests that the market is shifting towards projects with more sustainable value, especially altcoins with real-world value.