Michael Saylor Hints at Next Bitcoin Purchase as BTC Approaches All-Time High

.jpeg)

Michael Saylor, the executive chairman of Strategy (formerly MicroStrategy), has signaled that the company may be preparing to make another large-scale Bitcoin purchase. The move comes as BTC prices surged above the psychological $100,000 mark after a long period of fluctuating below it.

The Return of the Bitcoin Buying Strategy

On May 11, Saylor posted a screenshot from the company’s BTC portfolio tracker on Twitter, along with the terse caption: “Connecting the dots.” While he did not provide any details, the message was consistent with his usual teasing style, which often precedes the announcement of additional Bitcoin purchases by the company.

According to data platform Saylor Tracker, Strategy currently holds around 555,450 BTC, equivalent to more than $58 billion, cementing its position as the world’s largest Bitcoin holder.

Spillover impact on other markets and businesses

Strategy’s “uncompromising” investment strategy in Bitcoin has inspired many other businesses, especially in Asia. Metaplanet – a Japanese company that currently holds more than 5,000 BTC – is known as “MicroStrategy of Asia”. Metaplanet also recently established a branch in the US to expand its Bitcoin ownership strategy to the global market.

In the US, competition in the “corporate Bitcoin” sector is also heating up. Cantor Fitzgerald – a big name in the banking industry – has just partnered with stablecoin issuer Tether to establish a treasury organization specializing in managing BTC with an initial capitalization of up to $3 billion.

In addition, Strive – a company founded by politician Vivek Ramaswamy – has just merged with Asset to create a new rival in the race to own large-scale Bitcoin.

Bitcoin surpasses $ 104,000, close to old peak

Strategy's buy signal appeared amid the acceleration of the cryptocurrency market. Bitcoin price increased by more than 10% in the past week, surpassing the $ 100,000 mark for the first time since February this year. As of now, BTC is trading around $ 104,621, only about 4% lower than the historical peak of $ 109,021 reached in January.

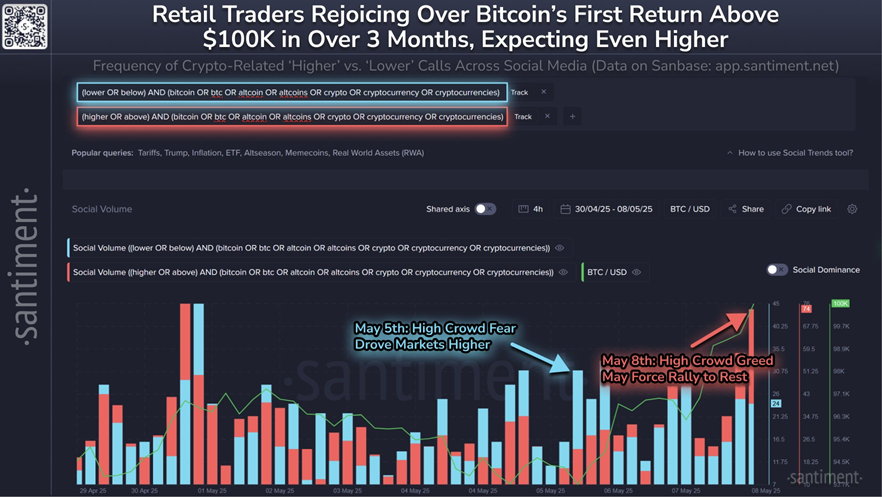

However, experts from Santiment warn that the market's excessive excitement could lead to short-term corrections. According to them, the sharp rise in FOMO (fear of missing out) sentiment among retail investors often coincides with local price peaks.

“Bitcoin is breaking through key psychological resistance levels. The current sentiment is bullish, but that can also be a double-edged sword,” Santiment noted.

Saylor remains bullish long-term

Despite the short-term concerns, Michael Saylor remains bullish on Bitcoin’s future. He believes that without the recent selling pressure from short-term investors, BTC could have broken above $150,000.

According to Saylor, institutional and long-term buying will continue to play a key role in pushing Bitcoin to higher levels in the coming period.