Major ETF Issuers Boost Bitcoin Buying Despite Market Volatility

Amid global financial market turmoil, new data from Arkham Intelligence shows that top Bitcoin ETF issuers Grayscale, Fidelity, and Ark Invest are increasing their BTC purchases. Specifically, ETFs recorded net inflows of $220 million yesterday alone, indicating growing confidence from institutional investors in the leading cryptocurrency.

Buying Signals Amid Market Volatility

Despite the recent sharp decline in the cryptocurrency market – partly due to the impact of former President Donald Trump’s controversial tariff policies – ETF issuers remain bullish.

Arkham Intelligence shared on social media:

“Donald Trump just taxed the world. So? Grayscale is buying Bitcoin, Fidelity is buying Bitcoin, Ark Invest is buying Bitcoin.”

The move comes amid widespread concerns about a global recession and the growing correlation between the crypto market and traditional stock markets (TradFi). However, unlike the negative reaction from most traditional assets, Bitcoin ETFs have maintained their appeal among large investors.

Shifting Market Sentiment

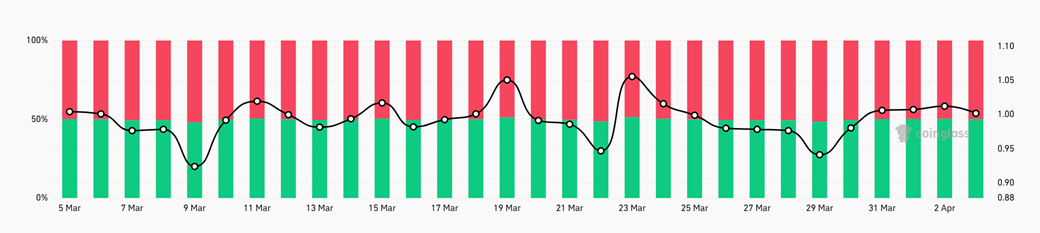

Bitcoin’s buy/sell ratio is also showing a notable shift. According to data from Coinglass, the ratio has shifted from 0.94 to 1, with the proportion of long positions currently at 50.5%, reflecting a balance in investor sentiment – no longer biased towards selling as before.

This shows that investors have neutralized the bearish trend, willing to wait for clearer signals from the market to take further action. In this context, ETF issuers are taking advantage of the temporary stabilization period to accumulate more BTC, preparing for a potential price increase.

Bitcoin ETFs Showing Enduring Interest

While there are still many unknowns surrounding new US tariffs and the global economic outlook, continued capital inflows into Bitcoin ETFs are an undeniably positive sign.

If this trend continues into the week, it could reinforce the belief that Bitcoin is becoming a true hedge against volatile traditional financial markets.

Coupled with strong on-chain data and moves from major financial institutions, BTC appears to be entering a period of strategic accumulation – the calm before the bull storm.