Is the Internet Capital Market Running Out of Breath? A Worry About the Sharp Drop in Trading Volume

The Internet Capital Market (ICM) sector is facing clear signs of a downturn after a short boom. In less than a week, trading volume and token creation have plummeted, causing many observers to question the sustainability and true future of the model.

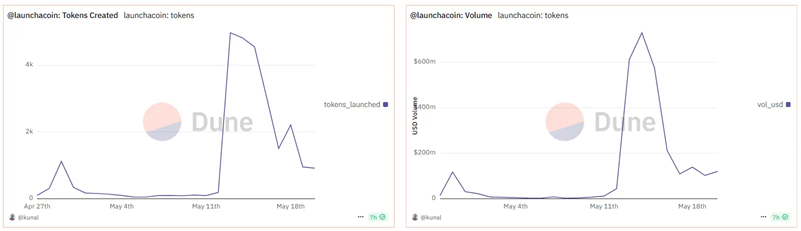

Trading Volume Plunges 80%, New Tokens Drop Nearly 77%

According to data from Dune Analytics, daily trading volume on the Believe app – a platform at the forefront of the ICM movement – has dropped from a peak of $729.3 million on May 14 to just $143.6 million on May 20. At the same time, the number of new tokens created has also dropped from 4,977 tokens per day to just 1,134.

While Believe has seen more than 23,000 tokens deployed since its launch, only about 5.3% of them have been activated, suggesting that the majority of tokens are either uninteresting to users or lack clear utility.

User Confidence Is Eroding

Analysts say the influx of “hollow” tokens – those lacking a supporting product or practical value – has led to user fatigue. Mars DeFi, a prominent industry observer, shared on X (Twitter): “We’ve reached a point of fatigue, not with token creation, but with tokens with nothing behind them. Users expect innovation, but what they get is noise.”

He argues that the original spirit of ICM – to foster innovation and launch projects with real value – is being distorted by a wave of meme-based speculation. “Gaming is not about launching a token and then disappearing. The power of ICM is about launching a product and building it publicly,” he added.

Believe and Base prepare to fight back

In the face of criticism, Ben Pasternak – the founder of Believe – announced plans to launch the Believe API, a tool that helps developers easily integrate tokens into real products. The initiative is expected to restore the balance between utility and assets, bringing ICM back to its original goals.

In addition, Jesse Pollak – Head of Base and Coinbase Wallet – said he remains optimistic about the long-term future of ICM, confirming that Base is seeing steady growth in the number of new projects and tokenized assets.

“We see the $14 billion+ assets on Base as the centerpiece of the emerging Web3 economy. Tokenizing everything will be the key to bringing a billion people on-chain,” he shared with BeInCrypto.

The Way Forward: Away from Speculation, Focus on Value

However, to maintain momentum, the ICM industry needs to prove its worth beyond the meme waves. Only projects with real products, clear applications, and long-term strategies can help ICM regain the trust of the community.

The question now is: Is this just a necessary adjustment, or a sign of the decline of a model that was exploited too early? The answer will depend on how developers and users shape the future of internet capital markets.