Is Bitcoin Still Profitable? A Hot Debate Among Financial Experts

Bitcoin (BTC) has long been seen as a symbol of wealth and financial freedom – a magical asset that once grew hundreds of percent per year, bringing with it the expectation of “flying to the moon” value. However, the latest debate among analysts suggests that this outlook may be changing.

Willy Woo: Bitcoin’s Golden Age May Be Over

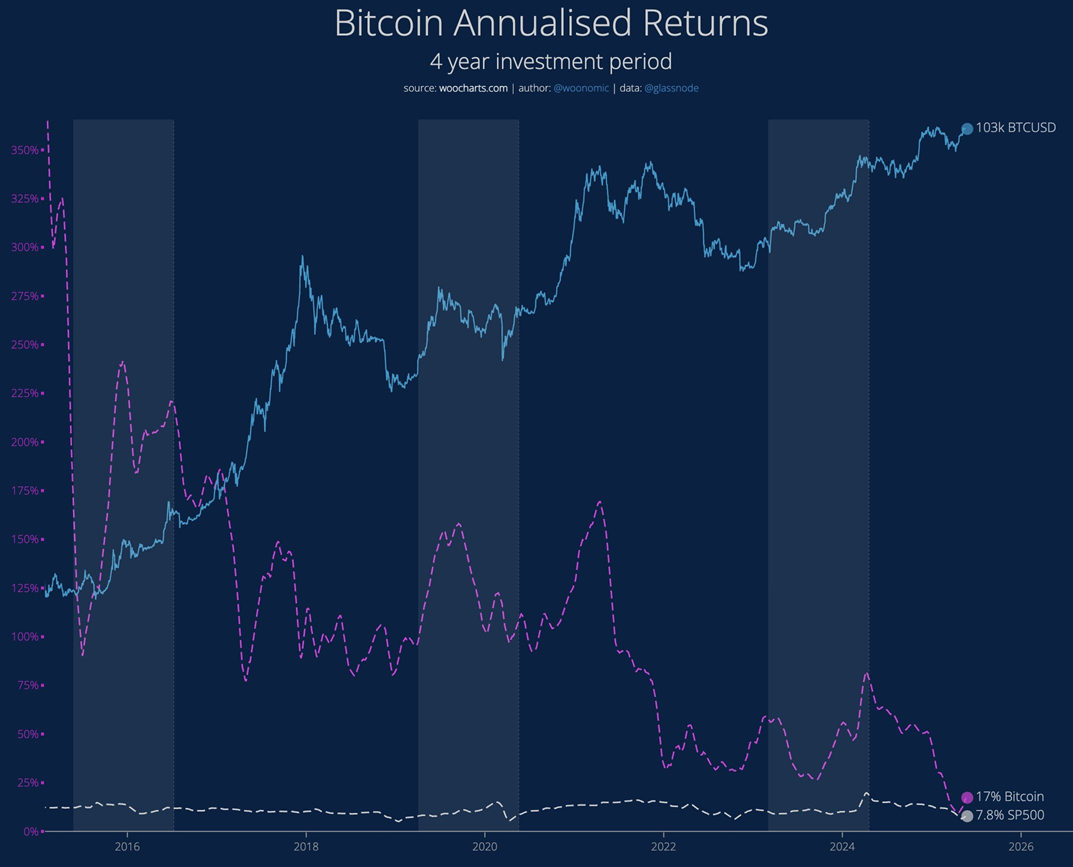

Prominent analyst Willy Woo believes that Bitcoin’s compound annual growth rate (CAGR) is slowing down and will continue to trend this way for the next 15–20 years, before stabilizing at around 8%. Woo shared a chart called “Bitcoin Annual Returns,” which shows that the CAGR exceeded 100% in 2017 but dropped to 30–40% after 2020 – when large institutions started accumulating BTC.

“Bitcoin is no longer the mythical unicorn that will rise indefinitely. We are past 2017,” Woo asserted. However, he still believes that even if the CAGR drops to 8%, BTC will still outperform most traditional assets.

Fred Krueger and Arthur Hayes: Bitcoin still has a long way to go

Rebutting the above view, investor Fred Krueger emphasized that BTC has increased 7-fold since its bottom in late 2022 and is currently trading around $103,000 (as of May 2025). He believes that the boom is still going on.

Even former BitMEX CEO Arthur Hayes made a bolder prediction: Bitcoin could hit $1 million before Donald Trump’s term ends. He expects BTC to hit $250,000 by 2025, equivalent to a 1,000% increase in just 4 years.

Liquidity – the dominant factor in asset markets?

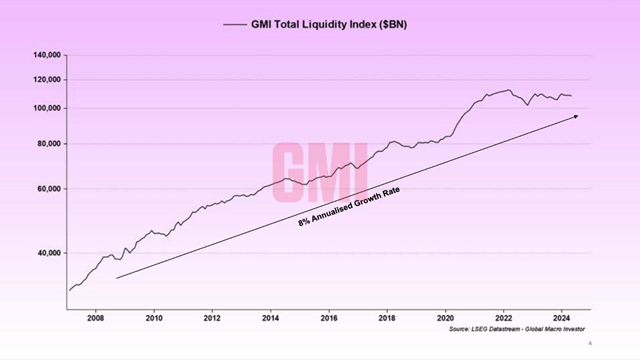

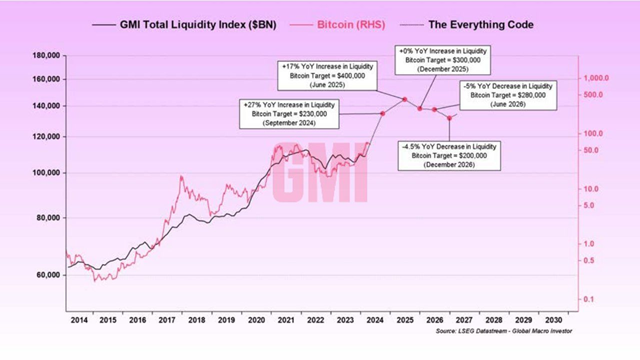

Putting aside the price debate, RealVision expert Paul Guerra offers a different perspective: global liquidity is the main factor driving asset values, including Bitcoin.

He said that in the context of assets such as stocks, bonds, real estate and BTC increasingly in sync, the core driver of the market is no longer “diversification” but the amount of money being pumped into the system.

“The population is aging, productivity is not growing, and public debt is escalating. To maintain GDP and pay off debt, governments have only one way: inject liquidity,” Paul said.

The global liquidity index is currently increasing by about 8% per year and is likely to continue to increase faster. According to Paul, if this trend continues, Bitcoin could reach $300,000 by the end of 2025, opening a powerful bull cycle that he calls the “Banana Zone” – where asset prices are pushed up by excess liquidity.

Warning: Technical risks still lurk

Although forecasts focus on macro factors such as GDP or liquidity, many technology experts warn that technical risks, especially the threat from quantum computing, could shake the security foundation of Bitcoin in the future.

Quantum computing, if developed strongly enough, could decode Bitcoin’s current encryption algorithms, threatening the integrity and trust in the system.

Conclusion: Bitcoin – still profitable, but no longer an “easy dream”

Bitcoin can still be profitable, but investors need to adjust their expectations. Instead of the hundred percent growth of the past, BTC is gradually becoming a more stable asset class, linked to macro factors such as liquidity, monetary growth and global policy.

The dream of "going to the moon" may still exist, but the road to get there will be more complicated and challenging than ever.