Grayscale Expands Top 20 Cryptocurrency Investments for Q2 2025 with Focus on DeFi and Intellectual Property Tokenization

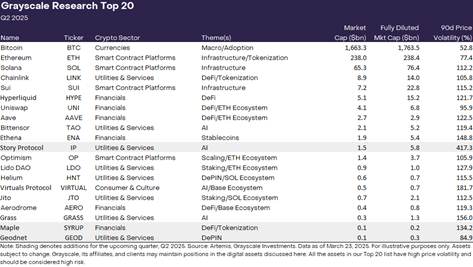

New York, March 2025 – Grayscale Investments, the world’s largest digital asset manager, today announced the inclusion of three altcoins in its top 20 cryptocurrency portfolio for the second quarter of 2025. The latest additions – Maple (SYRUP), Geodnet (GEOD), and Story Protocol (IP) – reflect emerging trends in decentralized finance (DeFi), decentralized physical infrastructure networks (DePIN), and intellectual property tokenization.

Grayscale's expanded portfolio highlights its strategic focus on five core sectors of the digital economy: currency, smart contract platforms, finance, consumer & culture, and utility & services. The company regularly reviews its asset allocation to identify the most promising technologies and use cases.

New Additions to Grayscale’s Top 20:

- Maple (SYRUP): A DeFi platform designed to streamline institutional lending and borrowing, providing transparency and capital efficiency.

- Geodnet (GEOD): A key player in the decentralized physical infrastructure network (DePIN) sector, supporting sensor data and IoT applications.

- Story Protocol (IP): An intellectual property (IP) tokenization platform that enables creators to tokenize and monetize their IP through blockchain.

These assets join a portfolio that reflects the growing importance of decentralized services and IP tokenization in reshaping traditional industries.

Portfolio Adjustments:

Grayscale also removed three assets from its top 20 list as part of its quarterly review: Akash Network (AKT), Arweave (AR), and Jupiter (JUP). This adjustment signals Grayscale’s focus on assets with the highest long-term growth potential.

“As the digital asset landscape evolves, Grayscale remains committed to providing investors with exposure to projects that offer innovative solutions across a range of sectors,” said Michael Sonnenshein, CEO of Grayscale Investments. “The addition of Maple, Geodnet, and Story Protocol underscores our belief in the transformative potential of DeFi, decentralized physical networks, and blockchain-based IP.”