Government-held Bitcoins Decline: The Fragile Trend of National Whales

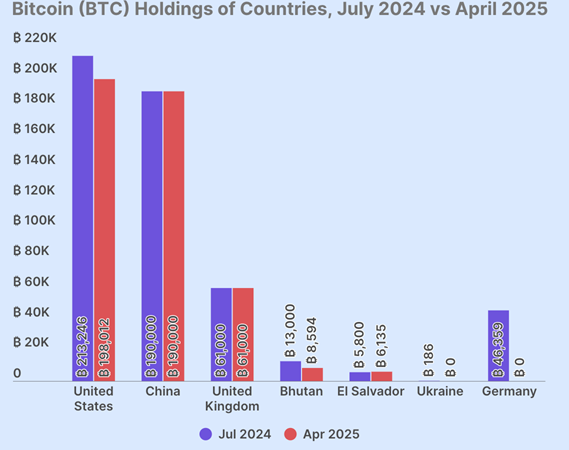

According to the latest report from CoinGecko, the amount of Bitcoin held by governments has dropped significantly over the past year. As of early 2025, the total number of BTC held by governments is only about 463,741 BTC, equivalent to 2.3% of the total supply, down more than 12% from the 529,591 BTC recorded at the same time last year.

Are governments gradually leaving the Bitcoin "playground"?

While the surface numbers are still impressive, the overall trend shows a clear decline. Of the seven governments that once held Bitcoin, two have completely liquidated their BTC, leaving only five countries holding some, and only El Salvador continues to actively buy more.

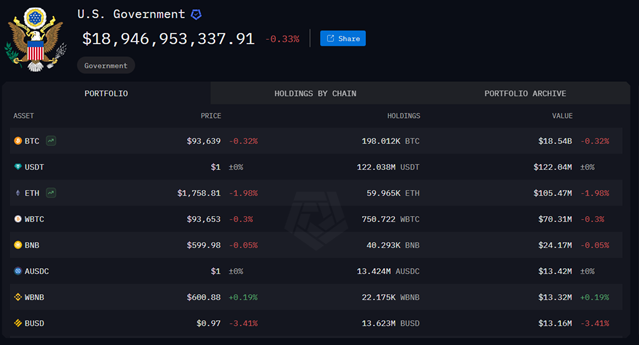

Notably, the US government is still the country with the largest amount of Bitcoin. However, this amount of BTC mainly comes from asset seizures in criminal cases, rather than through market purchases. Since the end of President Joe Biden's term, the US has begun to gradually sell off seized Bitcoin, and this digital asset management policy has continued under the Trump Digital Reserve, mainly to protect this asset and avoid negative impacts on the market.

Similarly, China — a country that has a strict stance on cryptocurrencies — currently holds about 200,000 BTC from seizures in 2020. However, this amount of Bitcoin has not had any clear liquidation moves so far.

In addition to the US and China, the UK also maintains Bitcoin holdings, while Germany sold all of its Bitcoin last year to support the national budget. Ukraine has also liquidated most of the BTC received from donations to finance its war with Russia.

What these countries have in common is that their Bitcoin holdings come from asset seizures or donations, not active investment.

El Salvador: A Rare Exception

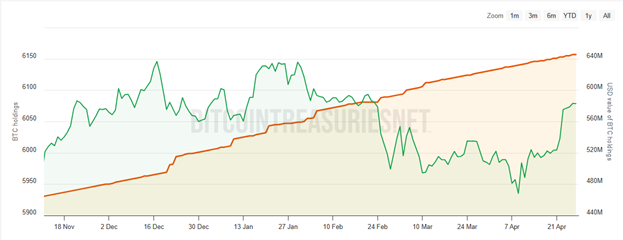

Of the countries that hold Bitcoin, only El Salvador — which has recognized Bitcoin as legal tender — continues to actively buy it. Despite pledging to limit Bitcoin purchases in order to reach a financial settlement with the IMF, El Salvador continues to increase its BTC reserves through 2025, despite some internal opposition.

Bhutan, another outlier, has also entered the Bitcoin market but primarily through mining. However, the country recently sold nearly half of its mined Bitcoin.

A dim outlook for government whales

While governments theoretically hold large amounts of Bitcoin, CoinGecko warns that the trend is fragile. The fact that the number of countries holding Bitcoin has dropped from seven to five in a year shows that political or financial policy changes can quickly change the landscape.

As large institutions and ETFs increasingly dominate the Bitcoin space, governments’ role as “whales” in the market is gradually shrinking — and their future Bitcoin ownership will depend heavily on strategic decisions in the coming period.