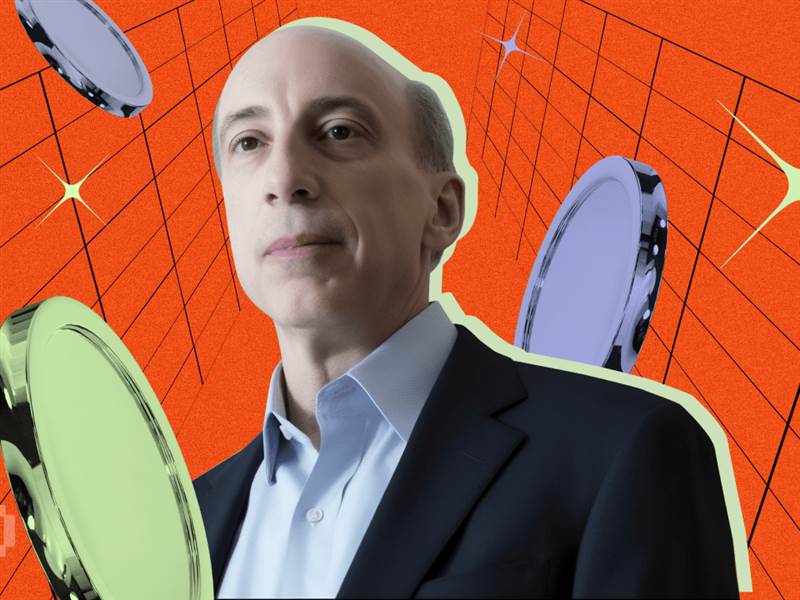

Gary Gensler: Bitcoin Will Last, While Most Altcoins Are Just Bubbles

In a recent interview with CNBC, former Chairman of the US Securities and Exchange Commission (SEC), Gary Gensler, expressed his opinion clearly: Bitcoin is likely to last for a long time, while most altcoins will gradually fade away over time. According to him, the key difference lies in the fundamentals and the level of global interest in each digital asset.

Bitcoin – Digital Gold of the New Age

“Bitcoin is likely to last because there are over 7 billion people in the world, and a lot of them are really interested in it,” Gensler said, likening BTC to a widely traded asset similar to gold – a precious metal that has held its position for thousands of years.

Gensler argues that Bitcoin is akin to a “digital precious metal,” separate from the rest of the cryptocurrency market. “We don’t have 2,000 precious metals, there are a few that are actually valuable,” he said, suggesting that most altcoins currently have no valid reason to exist in the long term.

Altcoins – A Market Driven by Crowd Psychology

While Bitcoin remains relevant due to community trust and verifiable scarcity, Gensler warns that many altcoins are driven largely by trends, social sentiment, and FOMO (fear of missing out) effects. “This market is very much based on emotion and very little on fundamentals,” he noted.

During his tenure at the SEC (2021–2025), Gensler was known for his hardline stance on regulating the cryptocurrency market. He has taken legal action against cryptocurrency exchanges and projects that he believes do not comply with federal securities laws.

While he declined to comment directly on the many lawsuits that have been dismissed since he stepped down as chairman, Gensler recommends that investors focus on assessing risks based on the actual fundamentals of each project.

No Crypto, Still Believes in Bitcoin's Future

Despite his scathing views on the altcoin market, Gensler admits that he does not own any cryptocurrencies — including Bitcoin. However, he still shows some confidence in the future of BTC, arguing that it can maintain its role as a store of value in an increasingly digital global financial landscape.

“Bitcoin is a globally relevant asset, not controlled by a central authority, and can continue to grow over time,” he said.

The Crypto Landscape – Filtering Out the Dregs to Keep the Gold

Gensler’s comments reinforce the long-standing argument that the crypto market will undergo a “natural cleansing” process, where weak projects, those lacking practical applications or relying on psychological leverage will soon be weeded out, while assets with solid fundamentals and high global adoption – like Bitcoin – will continue to survive and thrive as part of the future financial ecosystem.