Flashing Divergence: Is Bitcoin Heading for a June Correction?

While market sentiment remains positive and many financial institutions are bullish on Bitcoin’s short-term and long-term price forecasts, recent technical signals have raised alarm bells about an impending correction. A series of divergences have emerged, suggesting that the current rally may not be sustainable.

Price Divergence – A Potential Reversal Sign

Divergence occurs when an asset’s price continues to make new highs while technical indicators such as RSI, MACD or trading volume decline. This is a classic sign that the trend strength is waning – one of the first signals of a reversal.

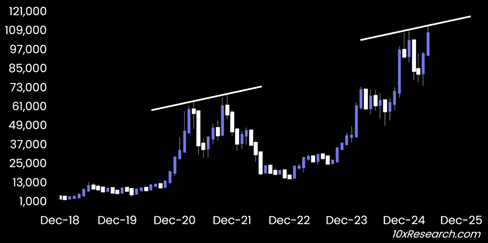

In the latest report from 10xResearch, experts warn that Bitcoin is approaching a strong resistance zone, recreating the double top pattern that appeared in 2021 – when Bitcoin reached a historical peak of $69,000 before plunging. According to the chart, the second peak is higher than the first but comes with weaker momentum – a similar situation is forming in the 2025 cycle.

Many technical signals are shining together

Not only on the monthly timeframe, analysts such as Matthew Hyland and Mitch Ray also noted negative divergence signals on the weekly and daily timeframes. Among them:

The RSI (Relative Strength Index) is making lower highs while the price is making higher highs – a clear bearish divergence.

The MACD Histogram on the daily chart also confirms the weakening signal, indicating that the bullish momentum is cracking.

Divergence Between Bitcoin and MicroStrategy (MSTR)

Another notable signal comes from the stock market. Analyst James Van Straten pointed out the divergence between the price of Bitcoin and the stock of MicroStrategy (MSTR) – one of the world's largest Bitcoin holders.

At the end of 2021, when Bitcoin peaked, MSTR stock plummeted by more than 50%. A similar scenario is playing out: MSTR has lost half its value from its late 2024 peak, while Bitcoin continues to peak above $111,000. According to James, this could reflect a cooling of large institutions and signal that the growth cycle may have peaked.

“Bitcoin has just had another strong month, but there are signs of a break below the surface. The deepening divergence between price action, trading volume, and investor behavior suggests the market may be entering a correction phase,” says a report from 10xResearch.

But will the 2025 market repeat 2021?

Despite the technical warnings, there is one important bright spot: the growing wave of Bitcoin accumulation from businesses outside of traditional finance. Companies in the gaming, healthcare, and retail sectors have begun to actively hold Bitcoin as part of their long-term financial strategies.

In addition, Bitwise forecasts that institutional investment in Bitcoin could reach $426.9 billion by 2026 – equivalent to 20% of the total Bitcoin supply.

These factors could make the difference between a 2025 cycle and a 2021 crash. However, investors should remain cautious about emerging technical signals and prepare their risk management strategies for a sudden correction in June.