Cryptocurrency Outflows Hit Nearly $800 Million: Investors Worry About Trump’s Tariffs

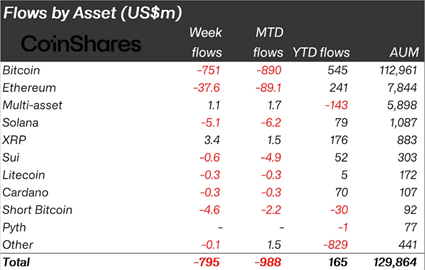

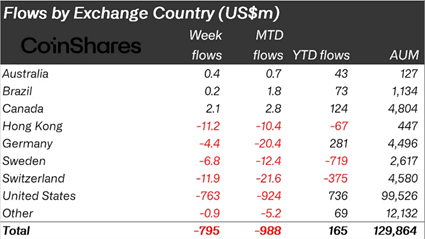

The third consecutive week saw net outflows from the cryptocurrency market, totaling $795 million, according to a new report from CoinShares. The main reason is believed to be investor uncertainty over former President Donald Trump’s recent tariff moves, along with uncertainty over the global economic environment.

Bitcoin Hit Hard, Altcoins Hold Strong

Data shows that Bitcoin continues to be the center of capital outflows, with negative outflows of $751 million in just one week. Meanwhile, several altcoins recorded positive outflows, including XRP, Ondo Finance (ONDO), Algorand (ALGO), and Avalanche (AVAX). This shows that some investors are shifting their strategies, withdrawing from Bitcoin to seek opportunities in altcoins that are less affected by the macro situation.

James Butterfill, head of research at CoinShares, commented:

“The recent tariff activity has had a strong impact on investor sentiment, making them more cautious about risky assets like Bitcoin.”

Bitcoin Spot ETFs Record Record Negative Flows

Bitcoin spot exchange-traded funds (ETFs) are no exception to the trend. The outflows from these ETFs reached $713 million, a 314% increase compared to the previous week ($172 million). This figure clearly reflects the decline in demand from institutional investors, especially in the US – which is directly affected by unstable trade policies.

Even “Bitcoin short” products – which typically grow in downtrends – saw no new inflows, with $4.6 million in outflows, suggesting overall investor reluctance to capitalize on the market reversal.

Tariffs Put Pressure on, But Asset Values Still Gain on Weekend Recovery

Despite the outflows, total assets under management (AuM) in the crypto market still rose to $130 billion, an 8% gain from the start of the week. The weekend recovery was attributed to Trump’s temporary relaxation of tariff policies, which provided short-term relief to the market.

Butterfill commented: “Trump’s temporary tariff reversal has helped the market regain some value, although risk sentiment remains dominant.”

Market Sentiment Shaken Across the Board

It is noteworthy that negative money flows are not concentrated in one region but are spread across markets from North America to Europe and Asia. This confirms that concerns about the US-China trade war and economic policy uncertainty are deeply affecting the entire digital asset market, especially institutional investment products.

In conclusion, the past week has been a clear demonstration of the connection between economic policy and crypto market sentiment. As the macro environment becomes more unpredictable, investors are responding by withdrawing capital, reducing risk and restructuring portfolios, especially moving away from assets like Bitcoin, which are susceptible to global political and financial news.