Cryptocurrency Market Turns Greedy as Whales Increase Bitcoin Accumulation

April marked a clear turning point in crypto investor sentiment as Bitcoin prices rebounded strongly, leading to a wave of optimism and accumulation from both institutional and retail investors. The current market action shows that greed is replacing fear, opening up new expectations for a sustainable growth cycle.

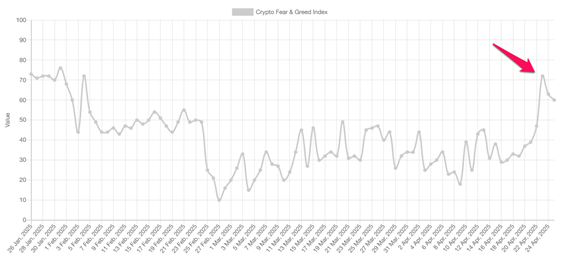

Market Sentiment Index Turns Bullish

According to data from Alternative.me, the Fear and Greed Index jumped from 18 (extreme fear) to 72 (high greed) in just a few weeks. Meanwhile, the same index from CoinMarketCap also increased from 15 to 52, reflecting that market sentiment is entering neutral territory. Despite the difference in scores, both indexes agree that the market has moved beyond the pessimistic phase.

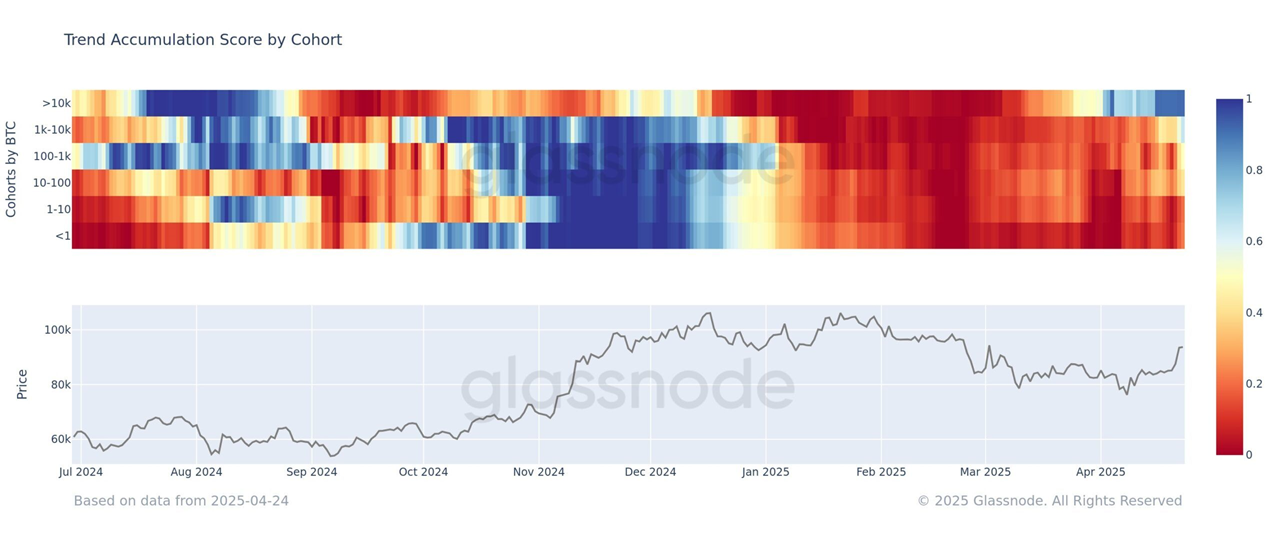

Whale Accumulation Strengthens Bitcoin's Uptrend

On-chain data from Glassnode shows that large wallets are playing a key role in keeping Bitcoin above $93,000. In particular, wallets with more than 10,000 BTC – often referred to as "whales" – have been accumulating with a score of nearly 0.9, indicating a strong buying trend.

Since mid-April, medium wallets (1,000–10,000 BTC) have also joined the accumulation race, pushing the index to 0.7. The color chart from Glassnode gradually shifted from yellow to green, reflecting a broad-based change in sentiment. According to the Glassnode team: "Big players have joined the rally."

Bitcoin ETFs See Record Inflows

Another factor contributing to the rally is the recovery of Bitcoin ETFs in the US. Over the past week, these ETFs have attracted a net $2.68 billion, with five consecutive days of positive inflows. This is a clear sign that institutional investors are returning to the market with increasing confidence.

Fidelity and ARK Invest raise long-term expectations

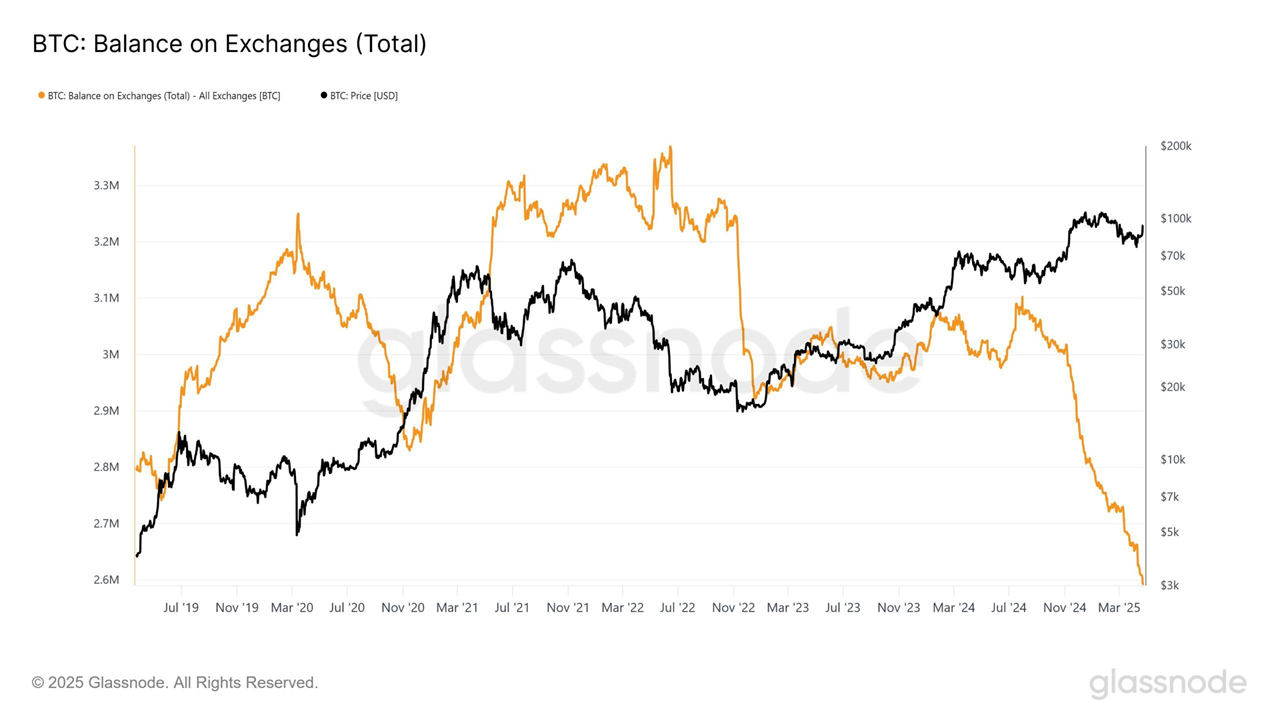

According to a report from Fidelity Digital Assets, the amount of BTC on exchanges has dropped to its lowest level since 2018, with only about 2.6 million BTC.

Since November last year, more than 425,000 BTC have been withdrawn from exchanges, indicating an increasing trend of long-term holding. Public companies are said to be buying more than 30,000 BTC per month since the beginning of the year.

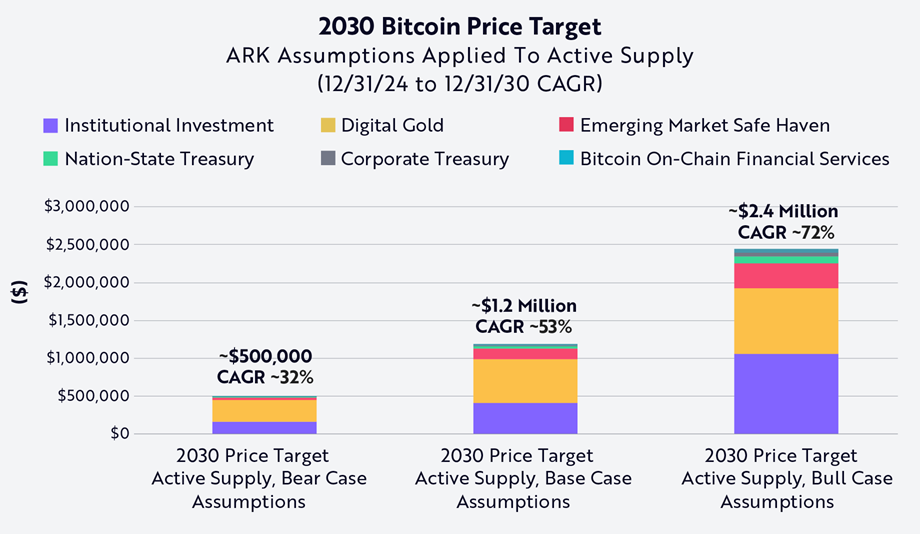

Meanwhile, ARK Invest – a famous investment fund led by Cathie Wood – has raised its Bitcoin price target to $2.4 million by 2030, significantly higher than its previous forecast of $1.5 million. ARK’s “Big Ideas 2025” report argues that Bitcoin’s adoption as a strategic reserve asset by governments and financial institutions is a key factor for long-term growth.

Cautious signals remain present

Despite the positive trend, many retail investors remain cautious. The phrase “Sell in May” has begun to reappear, indicating that concerns about macro factors such as interest rates, tariffs, and global political instability are still weighing on market sentiment.

Conclusion

With the combination of whale accumulation, ETF inflows, and long-term expectations from large investment funds such as Fidelity and ARK Invest, Bitcoin is facing a period of potential growth. However, in the context of the market still having potential risks, investors should consider carefully before making decisions and closely monitor global economic developments in the coming time.