Bitwise CEO Explains Why Bitcoin Search Volume Is Falling Despite Record Price Rise

Throughout Bitcoin's history, Google searches for the keyword "Bitcoin" have always been considered an important psychological indicator of the market. Periods of explosive search volume often coincide with strong price increases and a boom in retail investors. However, that trend is changing significantly.

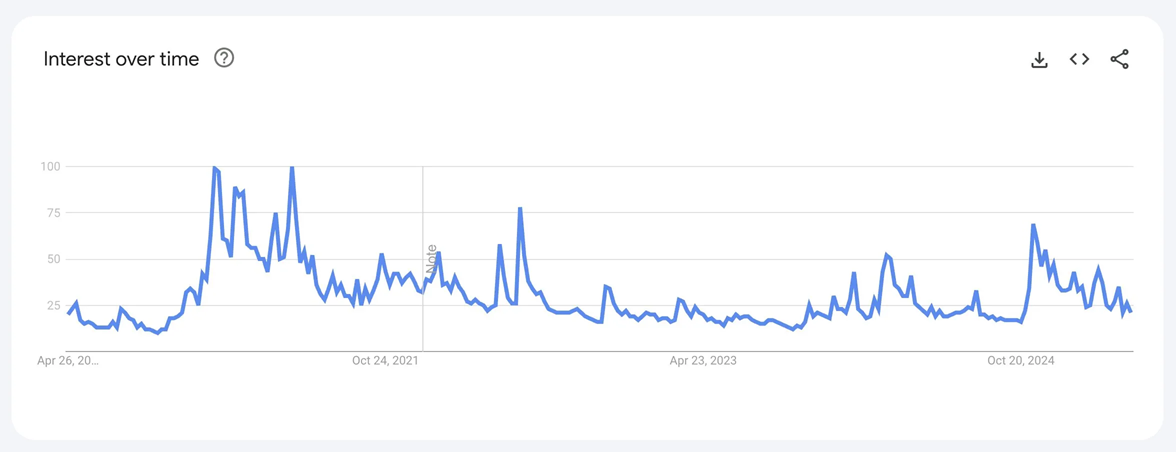

Hunter Horsley, CEO of Bitwise Asset Management, recently pointed out an unusual phenomenon: despite Bitcoin's continuous new highs around $90,000 by 2025, Google searches related to Bitcoin are at their lowest level in years.

Changing Market Structure: The Rise of Institutional Money

Data from Google Trends shows that interest in Bitcoin has fallen from around 75 points during the peak to 25 points in 2025 — a significant drop from the booms of 2017 and 2021.

Hunter Horsley believes that this rally is not driven by the FOMO (fear of missing out) effect from retail investors as before. Instead, strong money flows are coming from large financial institutions, investment advisors, businesses and even countries.

"Bitcoin is at $94,000, but Google searches for 'Bitcoin' are nearing a long-term bottom. This is not a game for retail investors. Large institutions are the main drivers," — Hunter Horsley shared.

Names like BlackRock, Fidelity and ARK Invest have led the wave of investment in Bitcoin through ETF products, contributing to pushing Bitcoin prices up without the need for massive participation from small investors like in previous cycles. Capital flows from Bitcoin ETFs are also considered an indirect channel for individual investors to access the market through financial institutions.

An investor commented on the X platform (formerly Twitter):

"Retail money has come in, but through institutions. When you see BlackRock, Fidelity or ARK buying Bitcoin, don't forget that it is still mostly retail money behind it."

According to the latest report from Fidelity, public companies have purchased nearly 350,000 more BTC since the US presidential election, with a purchase rate of about 30,000 BTC per month in 2025. At the same time, ARK Invest also predicts that Bitcoin could reach the $2.4 million mark by 2030, thanks to the increasingly widespread acceptance from the institutional sector.

Why is Bitcoin search volume decreasing?

In addition to changes in the structure of cash flow, there are many other factors that explain the sharp decline in Bitcoin search volume on Google Trends:

- Bitcoin is no longer new: After more than a decade of existence, Bitcoin has become a familiar asset. Those who are seriously interested in the market are now equipped with enough basic knowledge, no longer need to search for information as often as before.

- Changes in information search behavior: Many people today no longer rely primarily on Google to update about Bitcoin. Instead, they turn to social media platforms like X (Twitter), Reddit, or use AI tools to get information faster and more personalized.

Cryptocurrency Market Enters Maturity

The fact that Bitcoin has reached a historic high while public interest has declined shows that the market is entering a new stage of maturity. Instead of following trends and crowd psychology, Bitcoin is now seen as a strategic asset, systematically allocated in the investment portfolios of large organizations.

Although retail investors still play an important role, they now participate indirectly and more sustainably, through professional investment products, rather than in volatile speculative waves as before.