Bitcoin Whales Withdraw Over $280 Million From Exchanges: Bullish Signal or Signal for a Correction?

As Bitcoin continues to hover around $80,000, large moves from “whales” — investors who hold large amounts of BTC — are generating a wave of deep interest from the crypto community. Is this a sign of a further bull run, or just preparation for a deep correction?

Whales Withdraw Hundreds of Millions of Dollars Worth of Bitcoin From Exchanges

According to data from popular on-chain analytics account OnchainDataNerd, more than $280 million worth of Bitcoin was withdrawn from major exchanges on April 17 alone.

Specifically, Galaxy Digital withdrew 554 BTC (equivalent to about $76.74 million) from OKX and Binance. Meanwhile, Abraxas Capital withdrew 1,854 BTC (about $157.26 million) from Binance and Kraken.

Two other whale addresses (1MNqX and 1BERu) also moved a total of more than 1,000 BTC from Coinbase, worth more than $90 million.

These moves are generally interpreted as positive signals: the transfer of BTC to cold wallets reduces selling pressure in the market, demonstrating the long-term confidence of large investors in the value of Bitcoin.

Increase in new investors and positive technical signals

Not only are whales showing confidence, but the flow of money from first-time Bitcoin buyers is also increasing strongly. According to a report from Glassnode, the 30-day RSI of new buyers has reached 97.9 - a high that shows significant interest from new investors.

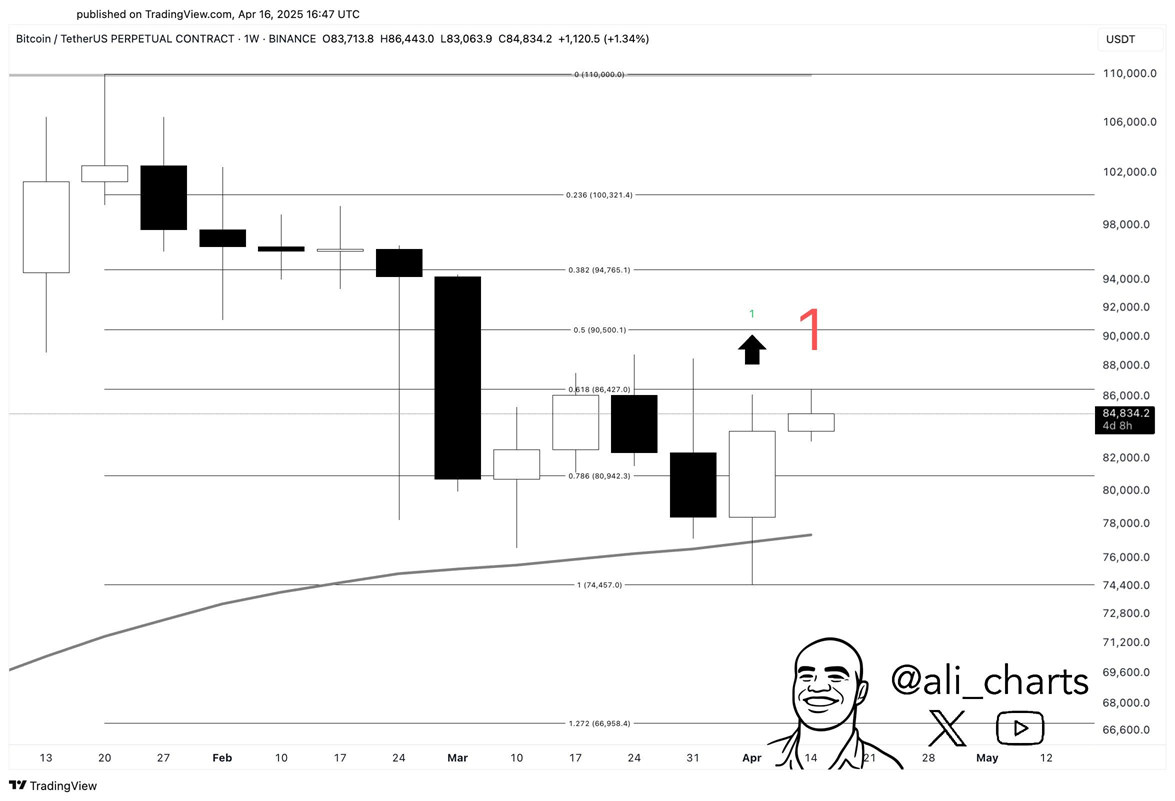

Meanwhile, analyst Ali on the X platform (Twitter) said that the TD Sequential technical indicator has flashed a buy signal on BTC’s weekly chart – a sign that has historically been associated with bull runs.

$86,000 – A Major Barrier to the Uptrend

However, to confirm a sustainable uptrend, Bitcoin needs to break and sustain above the key resistance level of $86,000. If it fails to break this barrier, a short-term correction could occur amid investor caution.

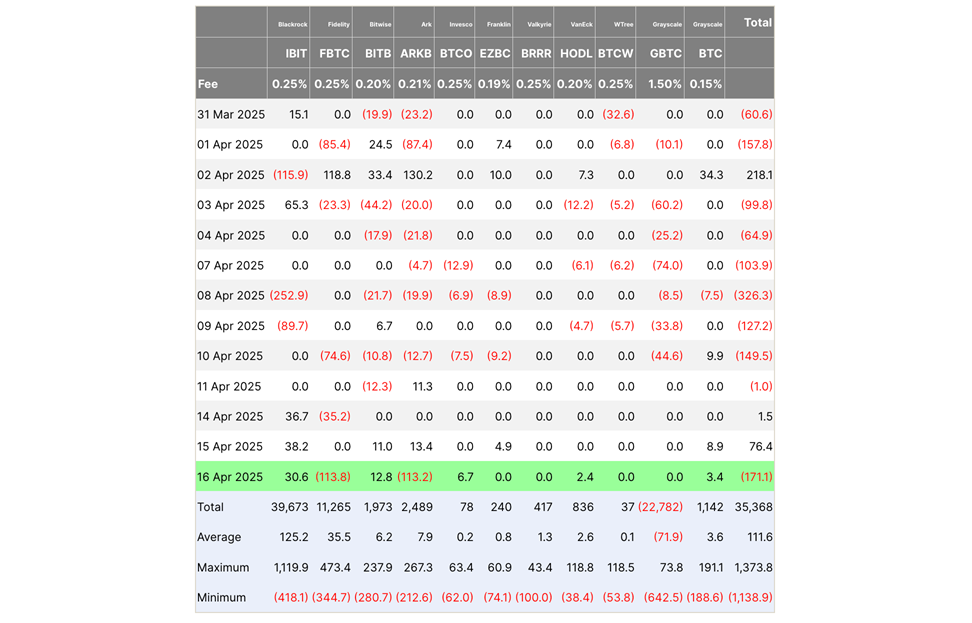

In fact, inflows into Bitcoin ETFs have recently dropped significantly, according to data from Farside. This could be a sign of waning short-term confidence from institutional investors.

Risks of BTC Unstaking

In addition, data from Lookonchain shows that more than $1.26 billion worth of Bitcoin has been unstaken from the Babylon platform. If a significant portion of these BTCs return to exchanges, selling pressure could increase, leading to a stronger price correction in the near future.

Conclusion

While technical indicators and positive moves from whales suggest Bitcoin’s upside potential, factors such as declining ETF inflows and the risk of BTC unstaking remain major unknowns. The question is: does Bitcoin have enough momentum to break above $86,000, or is this just the calm before the storm?