Bitcoin Price Action No Longer Follows Halving Cycle, Analysts Point Out Significant Changes

Bitcoin (BTC) has been known for its three clear Halving cycles, where supply decreases, demand increases, and Bitcoin prices surge. However, this fourth Halving cycle has brought about many different signs, no longer fitting the traditional price model as previous cycles.

According to recent data, Bitcoin prices appear to have deviated from their historical trajectory, with growth no longer being driven by the Halving event as before. Many experts in the crypto industry believe that Bitcoin is entering a completely new phase.

Bitcoin's Fourth Halving Cycle Divergence

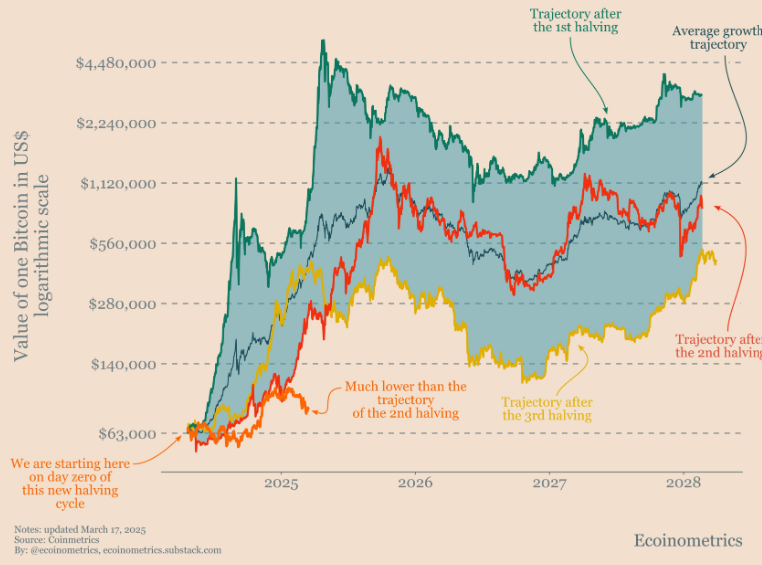

Observations from Ecoinometrics show that Bitcoin's price growth rate in this cycle has been much slower than in previous cycles. Instead of following a normal trajectory, Bitcoin prices have been hovering around lower levels than expected. In previous cycles, Bitcoin could have reached anywhere from $140,000 to $4.5 million, but now it is hovering around $80,000.

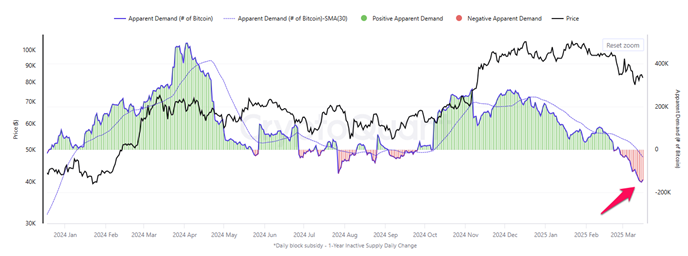

This discrepancy is highlighted by Bitcoin demand data, which has dropped to its lowest level in over a year, according to statistics from CryptoQuant. Bitcoin's "Apparent Demand" metric, which compares new supply to supply that has been dormant for over a year, has shown a marked decline in actual demand.

This means that while the halving event reduced Bitcoin supply, the price will have a hard time growing without an increase in capital inflows or interest from new investors.

Macro Factors Affecting This Halving Cycle

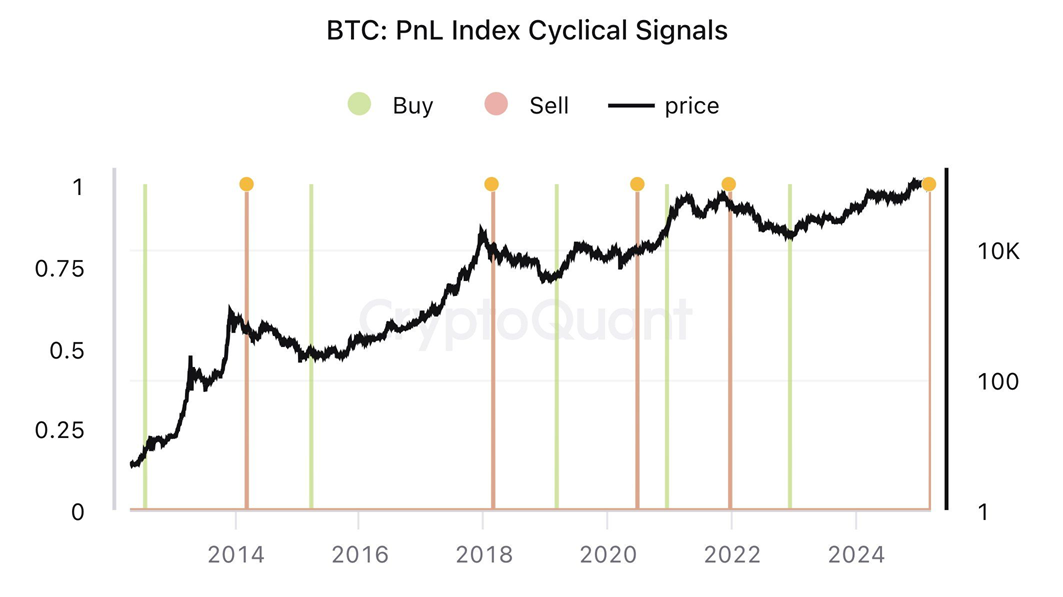

In addition to the decline in demand, Ki Young Ju, founder of CryptoQuant, analyzed cyclical indicators such as MVRV, SOPR, and NUPL, all of which signal that Bitcoin's bull run may be over. Based on these signals, he predicts that Bitcoin's price will decline or move sideways in the next 6-12 months.

Charles Edwards, founder of Capriole Investments, also highlighted an important difference in Bitcoin's current cycle. He said that in the previous cycle, expansionary monetary policies by central banks boosted Bitcoin's growth. However, currently, tightening monetary policies by central banks are limiting the growth of the crypto market.

However, Charles Edwards remains somewhat optimistic as he sees signs of a technical recovery in US liquidity. He believes that if this trend continues, it could create a major turning point for Bitcoin in 2025.

Is Bitcoin’s Future No Longer Reliant on Halving?

In this new landscape, macroeconomic factors and institutional capital flows may play a more important role in determining Bitcoin’s price trajectory than previous Halving events. This suggests that Bitcoin is entering a new phase where Halving is no longer the main driver of price, but rather external factors and institutional capital flows.