Bitcoin Overtakes Gold as Top Asset in US – A Historic Shift for Investors

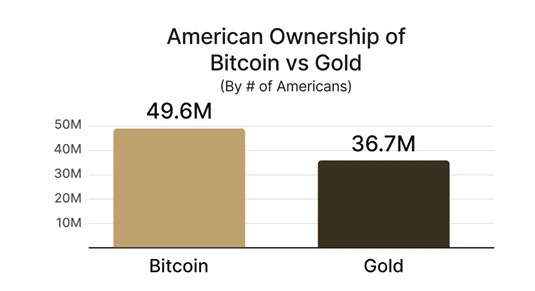

In a historic move, Bitcoin has officially surpassed gold to become the most-owned asset in the United States. According to the latest report from investment firm Bitcoin River, around 50 million Americans now hold Bitcoin, compared to just 37 million who own gold. This marks a major shift in the US public’s investment mindset – from traditional assets like gold to digital assets that represent the future.

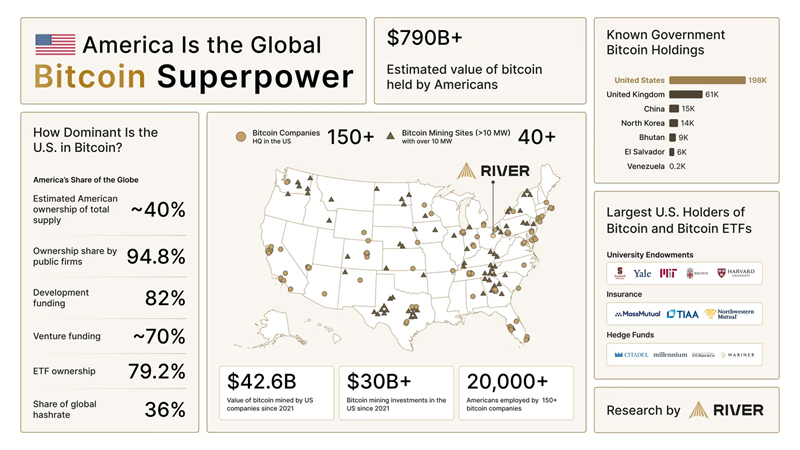

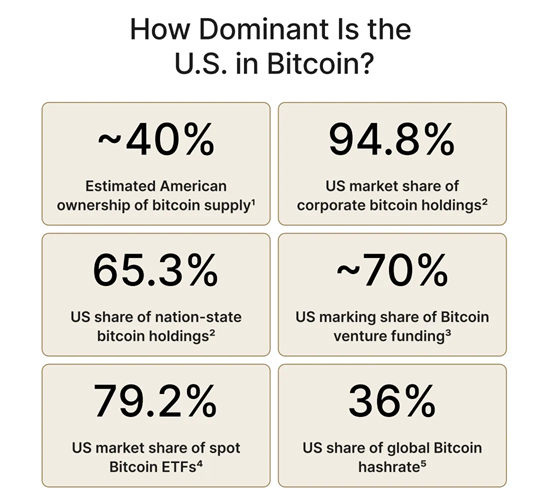

US Leads Globally in Bitcoin Ownership and Investment

A May 20 report from Bitcoin River highlights that the US is not only the leading country in terms of the number of Bitcoin users, but also the powerhouse of Bitcoin-related infrastructure and businesses:

40% of global Bitcoin companies are based in the US.

94.8% of the world’s publicly held Bitcoin is held by US companies.

The value of Bitcoin held by Americans is estimated at $790 billion – nearly equal to the entire gold reserves of many countries combined.

This shows a clear strategy: the US is gradually shifting from traditional financial dominance to a digital superpower, with Bitcoin at the center.

Bitcoin – A new pillar for US finance?

More than just an investment asset, Bitcoin is gradually becoming a part of the US economic structure and financial strategy. The River report argues that Bitcoin is “an underrated but potential pillar of US economic power in the new era.”

The flexibility in storing and transferring Bitcoin, along with the expectation that the US can build a strategic Bitcoin reserve, is making this digital currency gradually replace the role of gold in the minds of investors.

Why is Bitcoin “surpassing” gold?

Liquidity and accessibility: Bitcoin is easy to buy and sell, store in digital wallets, and does not require storage or transportation like gold.

Confidence from large organizations: The fact that big players like BlackRock, Fidelity, and ARK Invest are actively investing in Bitcoin through ETFs has added credibility to this asset.

Unstable economic context: Moody's recent downgrade of the US credit rating has led many to look to Bitcoin as a hedge against inflation and financial risks.

Risks remain, but confidence is rising

Although its impressive growth is undeniable, Bitcoin is still considered to be highly volatile, which may make some investors wary. However, with an increasingly clear legal environment and support from global financial institutions, Bitcoin is gradually consolidating its indispensable position in the American asset portfolio.

Conclusion

Bitcoin surpassing gold in the number of holders in the US is not only a symbolic milestone, but also a sign of a new financial era, where digital currencies could become the foundation of national economic policies. If this trend continues, Bitcoin will not only be “digital gold,” but the new heart of the global financial system.