Bitcoin Hits All-Time High, Global Businesses Rush to Accumulate Digital Assets

As Bitcoin continues to set new all-time highs (ATHs), a wave of adoption from traditional businesses is taking place stronger than ever. Unlike previous cycles that have mainly attracted individual investors and venture capital funds, 2025 is seeing the entry of companies from many non-tech sectors such as education, healthcare, construction, and even cybersecurity.

Non-tech Businesses Increase BTC Accumulation

May saw a notable event when Genius Group – a publicly traded education company – announced a 40% increase in its Bitcoin reserves, demonstrating long-term confidence in the digital asset. Shortly after, Basel Medical Group – a Singapore-based healthcare company – shocked the market by announcing a $1 billion investment in Bitcoin as part of its long-term asset reserve strategy.

In Europe, the trend is also strong. Sweden’s H100 Group has become the first company in the manufacturing sector to adopt a Bitcoin reserve strategy, investing NOK 5 million to buy 4.39 BTC. At the same time, Blockchain Group – a pioneer in Bitcoin holdings in Europe – added 227 BTC to its treasury, bringing its total holdings to 847 BTC.

“Europe is entering a period of strong accumulation at the corporate level,” said Coin Bureau CEO Nic.

Unrelated industries are also joining the race

Not only education and healthcare, but companies in the manufacturing, retail and construction sectors are also joining the race. BOXABL – a US-based modular home manufacturer – recently transferred part of its reserves to Bitcoin. Meanwhile, publicly listed electric vehicle retailer JZXN announced plans to buy 1,000 BTC over the next 12 months as part of its long-term financial strategy.

In the cybersecurity space, SecureTech announced plans to build its own Bitcoin reserve to ensure a solid financial position against market volatility. Roxom Global, a media company, has also raised $17.9 million to expand its operations and invest in Bitcoin.

These moves show that Bitcoin is no longer limited to the Web3 ecosystem, but is becoming a macro financial asset integrated into a variety of business models.

Bitcoin becomes a macro tool in a context of reduced supply

Despite the relative absence of retail investors in this bull run, large enterprises are creating a wave of widespread institutional FOMO. Strategy, one of the largest Bitcoin holders, now owns $64 billion worth of BTC and shows no signs of slowing down. The company has just announced plans to raise another $2.1 billion to continue its buying spree.

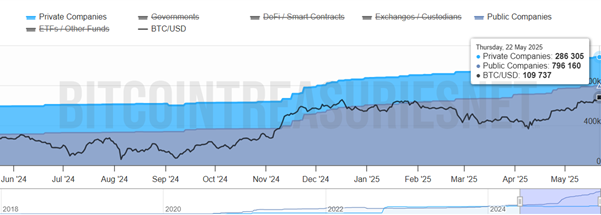

Data from BitcoinTreasury.net shows that private and public companies now hold a total of more than 1 million BTC – more than 5.4% of the total circulating supply. Meanwhile, Bitcoin’s supply remains fixed at 21 million coins, putting pressure on demand and prices amid growing institutional investment.

“Bitcoin’s move above $110,000 underscores an undeniable fact: it has moved beyond being a frontier asset and into a macro-financial instrument pursued by ETFs, governments, and global companies,” Mike Cahill, CEO of Douro Labs, said in an interview with BeInCrypto.

Conclusion: Bitcoin is no longer an alternative – it is the new norm

The dramatic rise in the number of companies accumulating Bitcoin is reshaping how the digital asset is viewed. Once considered a speculative bubble, Bitcoin is now taking center stage in the financial strategies of many large corporations. 2025 may be remembered as the year when the mainstream corporate world officially embraced Bitcoin as an integral part of the global financial future.