Bitcoin ETFs See $274 Million Inflows - Is a Recovery Underway?

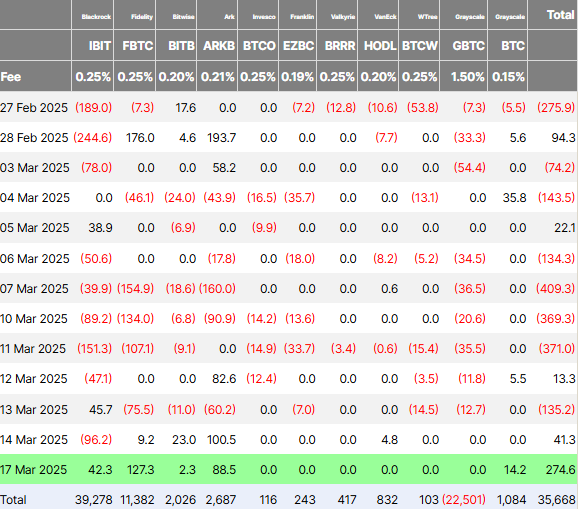

After weeks of outflows, Bitcoin (BTC) exchange-traded funds (ETFs) have seen positive growth again, with inflows hitting $274.6 million on March 17. This was the largest inflow in the past 41 days, drawing attention to the market’s resilience. However, the question is whether this is a sign of a return of demand for Bitcoin ETFs, or just a pause in a prolonged downtrend?

Bitcoin ETF Sees Large Inflows After Long-Term Downtrend

According to new data from Farside Investors, BlackRock’s iShares Bitcoin Trust (IBIT) attracted $42.3 million on Monday. Despite this, IBIT still faces many challenges due to the impact of the stock market and economic headwinds.

Among the major ETFs, Fidelity’s Bitcoin ETF (FBTC) performed the best, attracting $127.28 million, marking the largest inflow on the day. The ARK Bitcoin ETF (ARKB), managed by ARK Invest and 21Shares, also attracted significant inflows of $88.5 million. In contrast, the Grayscale Bitcoin Trust (GBTC), another prominent ETF, remained flat, while Grayscale’s other Bitcoin products recorded only a small inflow of $14.22 million.

While a positive day is not enough to establish a long-term trend, this strong growth is still a positive sign for investors tracking Bitcoin ETFs.

Market Factors and Impact on Bitcoin ETFs

However, the growth in Bitcoin ETFs is in contrast to the situation of Ethereum ETFs, as these funds continue to record consecutive outflows. Farside Investors reports that Ethereum ETFs have experienced their ninth consecutive day of negative inflows, with a total of $7.3 million in outflows, indicating a marked shift in investment preferences.

While the large inflows into Bitcoin ETFs could be seen as a positive sign, experts warn against rushing to conclude that this is a sustainable recovery. In recent times, Bitcoin ETFs have lost more than $4.5 billion in the previous four consecutive weeks, with strong capital flight due to regulatory concerns and economic uncertainty. This sentiment is not limited to Bitcoin, but is widespread across the entire cryptocurrency market.

Hedge Fund Involvement and Temporary Impact

Some analysts believe that the sudden inflows into Bitcoin ETFs may not represent new buyers, but rather the result of hedge funds and large institutional investors recycling capital to take advantage of short-term price volatility. Kyle Chassé, a crypto entrepreneur, believes that the majority of Bitcoin ETF trading is for arbitrage purposes, rather than a genuine need to hold Bitcoin. “Until there is real buyer participation, this volatility will continue,” he said.

In addition, policy decisions from the US Federal Reserve (Fed) are also an important factor to consider. Some investors expect the Fed to soon turn to quantitative easing (QE) to stimulate economic growth. However, many experts warn that this expectation may be misguided, as the Fed’s interest rates remain high, and QE has historically only been implemented when interest rates are close to zero.

Does this new influx of capital mark the return of Bitcoin ETFs, or just a temporary pause in the downtrend? This depends a lot on the market situation and upcoming policy decisions from the Fed.