Bitcoin ETFs Attract $744 Million in Flows After Five Weeks of Outflows

After five consecutive weeks of outflows, US spot Bitcoin ETFs have seen a strong recovery with a total of $744 million in inflows this week. On March 17, Bitcoin ETFs recorded $274 million in inflows, marking the largest single-day increase in over a month.

Return of Institutional Investors

This recovery shows that institutional investors are returning to the Bitcoin market as macroeconomic factors gradually stabilize. However, Bitcoin prices are still hovering below the $90,000 threshold, indicating that the market has not fully recovered to its record high.

Bitcoin ETFs Recover After Losing Over $5 Billion

Previously, Bitcoin ETFs in the US have lost over $5.3 billion since the second week of February, with March being the worst month with $3.5 billion in outflows. The main reason for this decline is investors' concerns about the volatile macroeconomic situation, combined with adjustments from global interest rate policies.

However, since the beginning of March, signs of recovery have begun to appear, as inflows into ETFs have grown steadily. With macroeconomic concerns easing, institutional investors are gradually regaining confidence. On March 21, Bitcoin ETFs continued to see $83.09 million in net inflows, marking six consecutive days of positive inflows.

Big Funds Drive

BlackRock’s IBIT led the way with $150 million in inflows on March 21. However, Grayscale still saw outflows, down $21.9 million on the same day.

The change suggests that institutions may be preparing for a potential market recovery. Many financial experts also believe that institutional investors are accumulating after liquidating during the volatile period.

Different Views

However, not everyone agrees with the bullish forecast. Some analysts warn that ETF inflows do not entirely reflect genuine buyer interest. Many institutions use arbitrage strategies, including trading between spot Bitcoin ETFs and CME futures.

According to Kyle Chasse, a prominent analyst, the demand for ETFs is real, but some of it is for arbitrage purposes. This could lead to short-term volatility in the market until real buyers step in.

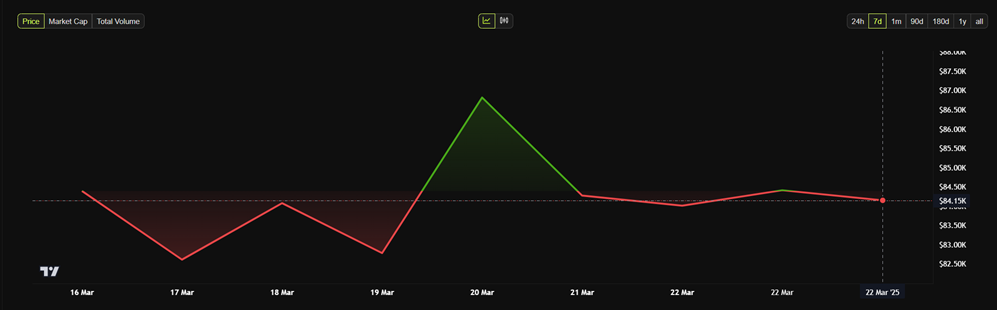

Markets remain volatile

At the time of writing, Bitcoin is trading around $84,148, down 0.46% over the past 24 hours. This suggests that while ETF inflows are increasing, they do not necessarily translate into an immediate rally.

Meanwhile, Ethereum ETFs continue to see outflows, with more than 12 consecutive days of outflows, indicating that concerns remain about crypto assets other than Bitcoin.