Bitcoin Dominance Hits Record High, Altcoin Market at a Crossroads?

Amidst a volatile crypto market, Bitcoin (BTC) dominance has just hit 64%, its highest level since the beginning of 2021, marking a period where Bitcoin continues to consolidate its leadership position. However, this has also left experts divided on the future of altcoins – is an altcoin season coming, or is the market still waiting?

Bitcoin Dominance – Opportunity or Threat to Altcoins?

Bitcoin dominance (BTC.D) represents the percentage of market capitalization that BTC holds compared to the entire crypto market. When this index increases, it shows that money is focusing on BTC instead of allocating to altcoins. This is considered a signal of defensiveness or caution from investors.

Since late 2022, the BTC.D index has been steadily increasing, now reaching 64%. According to Benjamin Cowen – founder of Into The Cryptoverse – if you exclude stablecoins, Bitcoin’s actual dominance is even higher, at around 69%. This shows that BTC is not only siphoning capital from altcoins, but also from stable assets.

Cowen believes that the current dominance increase does not show signs of an altcoin season. He believes that ALT/BTC pairs need to continue to correct lower before the market can enter a real recovery phase for altcoins.

Contradictory View – Altcoin Season May Still Be Coming

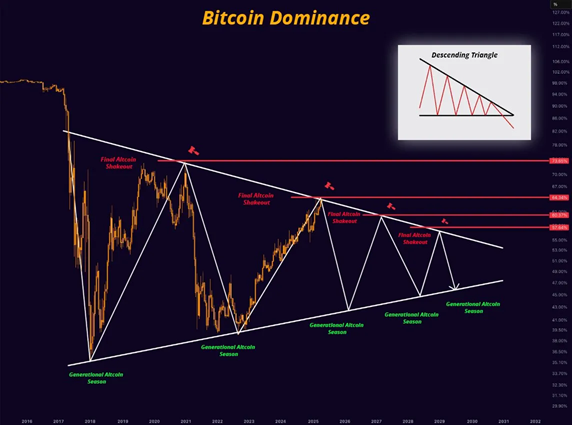

In contrast to Cowen, some other analysts believe that Bitcoin’s current dominance is approaching a strong resistance zone. Mister Crypto, for example, predicts that BTC.D may be moving within a descending triangle pattern – which often signals a pullback. If this happens, altcoins could take advantage of the opportunity and start a recovery.

An anonymous technical analyst also pointed to the resistance zone between 64% and 64.3%, saying that if Bitcoin fails to break above this zone, capital flows could return to altcoins in the short term.

However, if BTC.D breaks the resistance zone and moves above 66%, the selling pressure on altcoins will continue to increase – something that happened at the bottom of the 2020 bear market.

Stablecoins also play a decisive role

In addition to Bitcoin, the dominance of Tether (USDT.D) and USD Coin (USDC.D) is also being closely watched. Many technical analysts believe that these dominance indicators have hit resistance. If USDT.D falls, it means that money is flowing out of stablecoins – and most likely looking for ways to pour into altcoins.

Blockchain analyst Doğu Tekinoğlu believes that the combination of BTC.D, USDT.D, and USDC.D dominance charts is creating a potential signal for an upcoming altcoin season. When investors start to reduce their holdings of stablecoins, it is often a sign of renewed confidence in riskier assets like altcoins.

Markets Still Stuck

Junaid Dar, CEO of Bitwardinvest, took a more positive view, saying that if BTC.D falls below 63.45%, it could be a signal to trigger a strong altcoin rally. According to him, altcoins are currently “stuck” temporarily, and the breakout is just a matter of time.

However, with Bitcoin dominance still high and showing no clear signs of decline, the altcoin market is still in a tug-of-war. Will capital begin to disperse into smaller coins in the coming quarter, or will Bitcoin continue to hold absolute control?

As investors watch the movements of dominance metrics and money flow behavior, the summer of 2025 could be a defining period for both the altcoin market and the future of this crypto bull run.