Bitcoin Could Hit $2.4 Million by 2030? ARK Invest Sharply Raises BTC Price Forecast

In a notable move, ARK Invest – the well-known asset management firm founded by Cathie Wood – has just released an updated Bitcoin (BTC) price forecast for 2030, presenting an impressive bullish scenario of up to $2.4 million per BTC. This price is equivalent to a growth of more than 2,400% compared to the current trading price.

Previously, ARK’s prediction for 2030 was only $1.5 million. The 60% increase reflects growing optimism about Bitcoin’s long-term role and potential in the global financial ecosystem.

New Forecast: Bear Case Also Sharpens

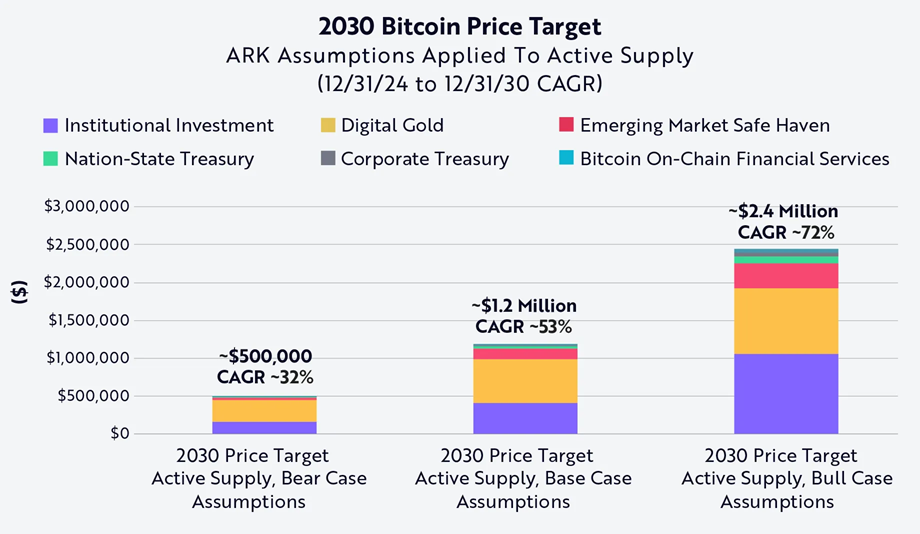

The report, published by analyst David Puell, outlines three scenarios:

- Bear case: Increase from $300,000 to $500,000 (CAGR of 32%)

- Base case: Increase from $710,000 to $1.2 million (CAGR of 53%)

- Bull case: Increase to $2.4 million (CAGR of 72%)

The figures are based on a TAM (Total Addressable Market) analysis, the penetration of key investor groups, and Bitcoin’s fixed supply schedule – which is expected to reach around 20.5 million BTC by 2030.

A notable improvement in this year’s report is the use of “active supply” – which excludes lost or out-of-circulation coins – which helps raise the target price is about 40% higher than traditional models.

Factors driving the bullish scenario

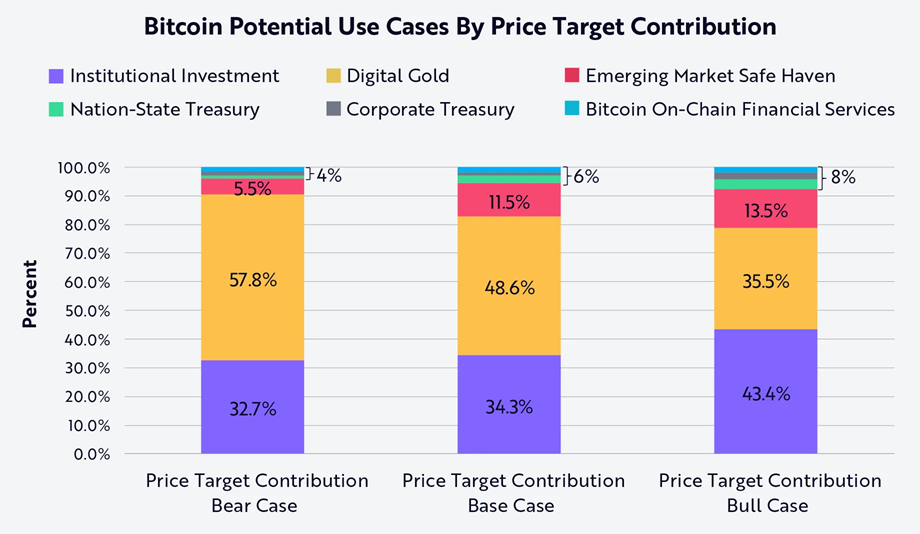

ARK Invest lists six key factors that could contribute to pushing Bitcoin to record highs:

1. Investment inflows from major financial institutions

2. Its role as a hedge against inflation and currency devaluation

3. Governments adopting BTC as a reserve asset

4. Corporate treasuries investing in Bitcoin

5. Growth of the decentralized finance (DeFi) system on the Bitcoin platform

6. Bitcoin's increasingly clear position as "digital gold"

While institutional investment is the most important factor in the bullish scenario, ARK also emphasizes that the involvement of governments and businesses – albeit smaller ones – still plays an important supporting role in the long term.

Other Bold Predictions

ARK Invest isn’t the only one betting big on Bitcoin’s future:

- Strategy founder Michael Saylor predicts that BTC’s market cap could reach $500 trillion, or $23.8 million per coin.

- Standard Chartered expects BTC to hit $500,000 by 2028.

- IREN CEO Daniel Roberts believes BTC could hit $1 million within five years.

- Apollo’s Thomas Fahrer and Pixelmatic’s Samson Mow are also betting on $1 million, even as early as 2025.

- US investment bank H.C. Wainwright has raised its 2025 Bitcoin price forecast from $145,000 to $225,000.

- Fundstrat’s Tom Lee believes Bitcoin could surpass $150,000 next year.

The Future Is Still a Question, but Expectations Are Clear

While the predictions are speculative, they do indicate a growing belief among large institutions and individual investors that Bitcoin will play a central role in the future global financial system.

However, the cryptocurrency market is inherently risky and volatile. Any forecast should be considered in conjunction with macroeconomic developments, regulatory developments, and global adoption.