Bitcoin Beyond HODLing: How Babylon and SatLayer Shape the Future of Bitcoin

Bitcoin has long been considered digital gold, a solid store of value in the crypto economy. However, with the rapid growth of decentralized finance (DeFi) and advanced blockchain solutions, more and more investors are looking to leverage Bitcoin in a more active way, rather than just passively holding it.

Babylon, a leading Bitcoin staking platform, is paving the way for this change. Through its Bitcoin reset and new security mechanisms, Babylon not only opens up opportunities for yield generation but also makes Bitcoin an integral part of the decentralized finance ecosystem. BeInCrypto spoke with the Babylon founding team to learn how they are changing the way the world uses Bitcoin.

From Store of Value to Yield-Generating Asset

According to Babylon’s representative, Bitcoin is not only a store of value but also has the potential to secure and support new financial protocols. While Ethereum (ETH) and Solana (SOL) have long enabled staking and yield generation, Bitcoin has largely remained passive in the ecosystem. This has led many Bitcoin holders to want to participate more deeply in DeFi activities without leaving the Bitcoin ecosystem.

“Bitcoin holders have observed how Ethereum has developed with its staking and reward mechanism. They also want to take advantage of this but do not want to sacrifice the security and decentralization of Bitcoin. We have created a mechanism that allows them to participate in staking BTC without transferring assets to another blockchain,” Babylon’s representative shared.

Bitcoin Staking and Babylon: A New Approach

The core of Babylon’s strategy is to allow users to stake Bitcoin to support the security of the DeFi network and earn profits from it. Instead of leaving BTC sitting in their wallets, holders can use their assets to provide liquidity, secure transactions, and earn staking rewards.

“We leverage Wrapped Bitcoin (WBTC) and Bitcoin Liquid Staking Token (LST) to make it easy for users to participate in this process. Not only that, Babylon is also partnering with SatLayer to scale and improve the performance of the system,” the Babylon team revealed.

Partnering with SatLayer: Accelerating the Development of Bitcoin DeFi

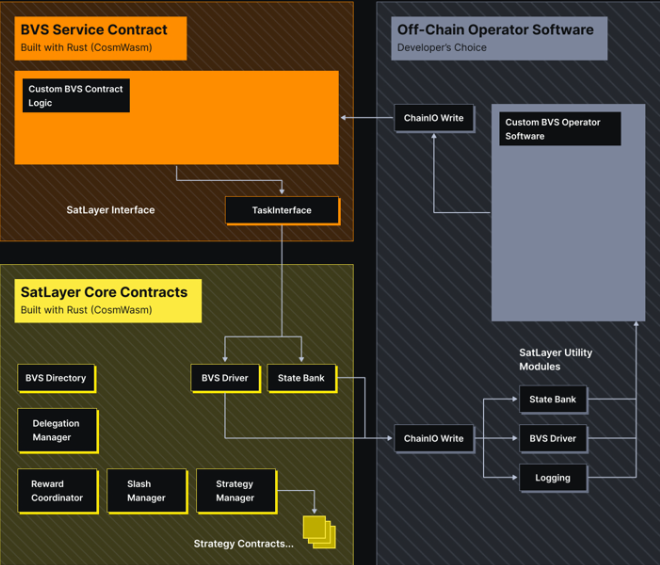

The partnership with SatLayer is an important step forward, helping to improve the integration of Bitcoin into the decentralized finance ecosystem. SatLayer provides the necessary infrastructure for Bitcoin to be reset safely and efficiently.

“By combining our solution with SatLayer, we are creating a more robust Bitcoin-based DeFi model. Users will be able to leverage BTC to provide liquidity, secure dApps, and earn rewards without the risk of custody,” Babylon emphasized.

The Future of Bitcoin: Towards a Comprehensive Decentralized Finance Ecosystem

Babylon believes that Bitcoin will not stop at being a store of value. As the infrastructure develops, Bitcoin can become a versatile asset that supports the digital economy without losing its core values.

In the future, Babylon and SatLayer plan to expand Bitcoin’s capabilities in DeFi, including AI-powered yield optimization, Bitcoin-powered on-chain insurance, and improved staking mechanisms. The development of this ecosystem will help Bitcoin become a true financial instrument instead of just a passively held asset.

“As Bitcoin continues to evolve, we believe it will move beyond its role as a store of value. With innovations like staking, restaking, and decentralized security, Bitcoin could become central to the global financial system,” the Babylon team concluded.

Babylon and SatLayer’s Bitcoin staking innovation marks a major turning point for the cryptocurrency ecosystem. As more Bitcoin holders look for ways to optimize their holdings, solutions like these could be the key to ushering in a new era for the oldest digital currency.