Bitcoin and Altcoins: Is the Altcoin Season Delayed by BTC’s Growing Dominance?

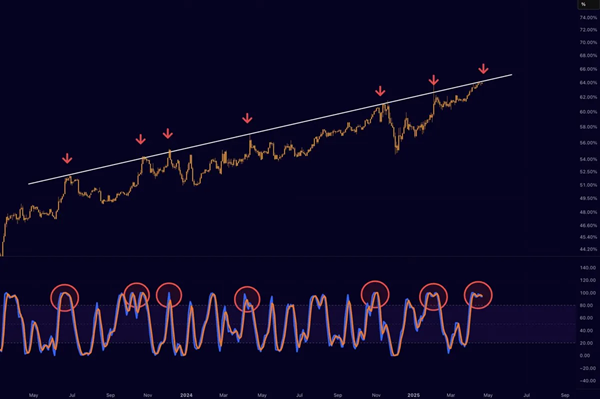

The significant increase in Bitcoin’s market dominance (BTC Dominance - BTC.D) is raising a big question for the investment community: is the Altcoin season really coming, or is it being held back by a Bitcoin-only capital inflow?

The BTC.D ratio is currently at 64.5%, its highest level in over four years. This reflects a strong investment bias towards Bitcoin amid global economic uncertainty and growing institutional money inflows into the cryptocurrency market.

Divergence in Expectations

Some analysts like Mister Crypto believe that a BTC.D correction is inevitable. He predicts: “When the BTC Dominance index is rejected at the current resistance zone, it will be a signal for altcoins to break out strongly.”

Similarly, trader Merlijn expressed optimism that “Altseason is coming this year, just be patient.”

However, not everyone shares the same view. Scott Melker, host of the popular podcast *The Wolf Of All Streets*, believes that the current market cycle may not follow the traditional trajectory. He believes that this time, money is pouring into Bitcoin from new sources such as ETFs, institutions, and even governments, rather than the internal flows from altcoins to BTC as in the past.

“You can’t take money out of an ETF to buy meme coins,” Melker wrote, highlighting the clear shift in investment behavior.

Altcoin capitulation?

According to Melker, much of the altcoin decline has not come from investors moving capital into Bitcoin, but from them being forced to sell due to financial pressure. This suggests a sign of “capitulation” rather than a portfolio adjustment strategy.

Meanwhile, Bitcoin is being viewed as a hedge against inflation – similar to gold. One analyst commented: “There are not many options left other than BTC and gold for safe haven assets.”

What are global flows saying?

The US Dollar Index (DXY) has just dropped to a three-year low, fueling a new Bitcoin rally. BTC has surpassed the $88,000 mark, hitting a high not seen since the Liberation Day holiday. Gold is no exception, hitting a new record high of $3,456 per ounce.

According to The Kobeissi Letter, the price of gold has increased by more than 47% over the past 12 months – and Bitcoin is following a similar trajectory.

Altseason still far away?

While the market is still hoping for an explosive Altcoin season, the current reality is that BTC is absolutely dominant. With strong institutional support and an uncertain global economic backdrop, Bitcoin appears to be positioned as a more stable asset than ever.

However, if a dominance correction occurs, it could be a major catalyst for altcoins. The question is no longer “if” – but “when.”