Binance Continues to Delist Altcoin/BTC Pairs in 2025 – What to Watch Out For?

In previous years, Altcoin/BTC trading pairs were the main channel for investors to increase their Bitcoin holdings. However, the shift in trading trends and the growing preference for stablecoins has led to the decline in the importance of Altcoin/BTC pairs. 2025 marks a turning point when many of these trading pairs are delisted, reflecting the change in investor trading behavior.

Binance Continues to Delist Altcoin/BTC Pairs

Binance, the world’s leading cryptocurrency exchange, has delisted more Altcoin/BTC trading pairs in 2025. Today, Binance announced the removal of several trading pairs including MDT/BTC, MLN/BTC, VIB/BTC, VIC/BTC, and XAI/BTC. This is mainly due to low liquidity and reduced trading volume.

According to Binance, the delisting of Altcoin/BTC pairs is the result of regular market quality reviews. This ensures an optimal trading experience and protects users' interests. Previously, Binance also carried out similar delistings during the year, with a total of 34 trading pairs removed, of which up to 50% were Altcoin/BTC pairs.

Smooth trading with TradingPlatform

KYC-free crypto trading - 100% anonymous.

Earn a welcome bonus of up to $2000!

The decline in liquidity and profitability from Altcoin/BTC pairs may explain this decision. Currently, traders tend to focus more on Altcoin/USDT pairs, as these pairs not only offer high liquidity but also have lower risks.

Retail Investors Shift Capital to Altcoins

According to a report from CryptoQuant, retail investors have been reducing their Bitcoin holdings since Q4 2024, while institutions have been actively accumulating more. After the approval of the Bitcoin ETF and the return of President Trump, institutional investors have dominated the Bitcoin market. This has caused retail investors to shift more investment to altcoins and meme coins, looking for short-term growth opportunities.

Double Risks of Trading Altcoins/BTC

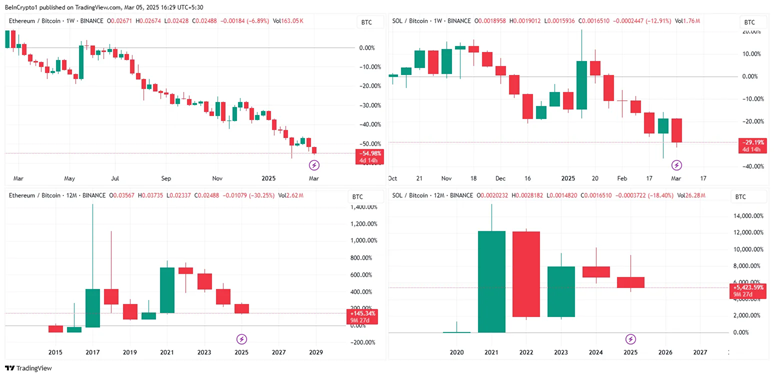

Trading Altcoin/BTC pairs means that traders are exposed to both Bitcoin and altcoin volatility, which increases the risk. Even the most popular pairs such as ETH/BTC or SOL/BTC show a prolonged decline throughout 2025, with high volatility. This has led many traders to lose interest in Altcoin/BTC pairs and switch to Altcoin/Stablecoin pairs such as Altcoin/USDT.

The volatility charts of ETH/BTC and SOL/BTC clearly illustrate the sharp downward trend over the past year. This has increased the risk of capital loss for holders of these trading pairs, leading them to prioritize trading Altcoin/USDT pairs to take advantage of the high liquidity and relative stability of stablecoins.

USDT – The Preferred Choice of Investors

Data from CoinMarketCap shows that USDT remains the dominant stablecoin, with a daily trading volume exceeding $115 billion, accounting for the majority of the total trading volume of the entire market. This reinforces USDT’s position as a primary vehicle for crypto traders globally.

As the crypto market continues to grow, the focus on Altcoin/USDT pairs shows a clearer trend among investors, while also representing a shift away from Altcoin/BTC pairs that have been risky in recent years.