Altcoins Face Severe Crash: Swan Study Clarify Bitcoin's Overwhelming Superiority

A new study from Bitcoin financial services firm Swan has raised concerns in the crypto community, showing that the majority of altcoins (alternative cryptocurrencies) are rapidly and systematically collapsing against Bitcoin (BTC).

The report not only provides data on the long-term underperformance of altcoins, but also reinforces Bitcoin's position as a more stable and reliable digital asset for preserving capital.

Altcoins: A High-Risk Investment Option?

In a thread shared on the X platform (formerly Twitter), Swan pointed out that: "Altcoins are not just underperforming Bitcoin — they are actually collapsing against it."

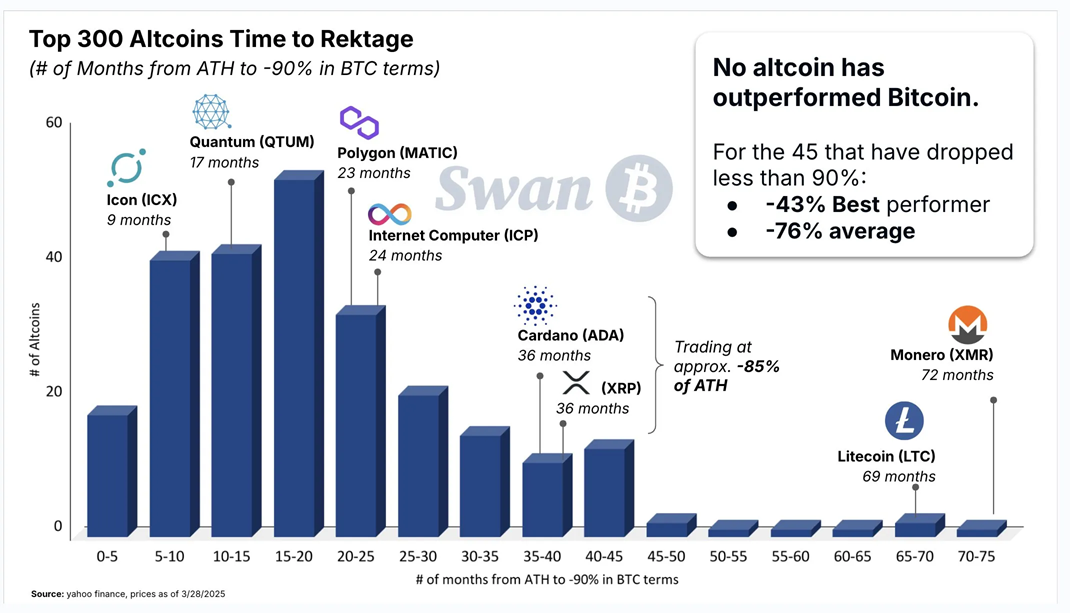

Their study analyzed the top 300 altcoins over a five-year period, focusing on how long it took for them to lose 90% of their value in BTC terms after reaching their all-time high (ATH).

The results showed that the average altcoin took just 10 to 20 months to reach -90%. Notably, some altcoins like Terra (LUNA1), Ontology Gas (ONG), and Bitgert (BRISE) fell in less than two months.

Even big names like Cardano (ADA) and XRP were not immune to this trend, taking 36 months to lose 90% of their value from their peak. Litecoin (LTC) took 69 months, while Monero (XMR) was the most resilient altcoin, taking six years to fall by the same amount.

Slow to Crash Doesn’t Mean Safe

The study also identified 45 altcoins that haven’t hit the 90% mark, but have lost an average of 76% of their value relative to Bitcoin. Even the “best” altcoin in the group has fallen 43%.

This doesn’t indicate a recovery or long-term potential, according to Swan, but simply a delay of the inevitable.

“Bitcoin remains the standard for capital preservation. These assets are not alternative safe havens – they are bleeding against Bitcoin,” the firm concluded.

Blind faith in the “alt season” is faltering

The optimism of an “alt season” boom may be fading. Growing market saturation is making that belief more fragile than ever. According to CoinMarketCap, more than 1.8 million tokens have been created in the past month alone – a whopping number.

However, the true value of these tokens is largely driven by short-term speculative trading rather than long-term sustainability. BeInCrypto also recently reported that 89% of tokens listed on Binance in 2025 are losing money.

In addition, the explosion of new tokens is diluting market liquidity and making an “altcoin season” increasingly unlikely.

Bitcoin: Impenetrable Stronghold?

The biggest difference today is Bitcoin’s growing dominance. Institutional adoption, large investment funds, and regulatory attention have created a solid foundation for Bitcoin that most altcoins cannot match.

Swan CEO John Haar commented: “With that kind of performance, it’s surprising that altcoins are still around. But it’s understandable – people like to gamble.”

Conclusion

Swan’s data is a wake-up call for investors about the risks of pursuing alternative assets in the crypto market. As Bitcoin continues to assert its role as “digital gold,” most altcoins appear to be short-term gambles lacking a long-term value foundation.

Do you think altcoin season will return, or is this the end of their heyday?