3 Internet Capital Market Trends to Watch in 2025

Internet Capital Markets (ICM) are emerging as a disruptive force, disrupting traditional fundraising models by opening up funding opportunities to anyone with an idea, be it a tech startup, a meme, or even a social experiment. But is ICM a fad or a long-term innovation?

1. Tokenization of Fundraising: Permissionless Capital Takes Over

Instead of going through rigorous vetting, ICM allows anyone to launch a token without having to present a roadmap, raise funds from venture capitalists, or prove the capabilities of their team. This democratization has turned projects like LAUNCHCOIN into a prime example: a token launch platform on the Believe app, where anyone can bring their idea to market.

What’s more important is that ideas are now more important than financial principles. Stories, communities, and virality are becoming the key drivers of liquidity and valuation.

2. Artificial Intelligence: A Companion to Decentralized Investment

ICM is becoming an ideal environment for AI projects to raise capital. From Yapper - an AI-powered social media content optimization tool, to Creator Buddy - a deepfake platform for creating lip-syncing videos, or Kingnet AI - a no-code Web3 game creation tool, all are leveraging the power of crowdfunding to bring AI closer to the public.

The combination of AI and ICM is paving the way for decentralized technology products, beyond the traditional venture capital framework.

3. Social Media: Turning Engagement into Market Capitalization

Web3 has taken over the role of social media platforms as trust in "giants" like Facebook or X has declined. Many startups like VINE (on Solana) and JellyJelly have used ICM to redefine the concept of “fundraising”. Without the need for lengthy IPOs, platforms can now raise capital directly from users based on the level of engagement.

In this model, every like, share or video view can be converted into tokens and financial value.

ICM: A passing trend or a long-term turning point?

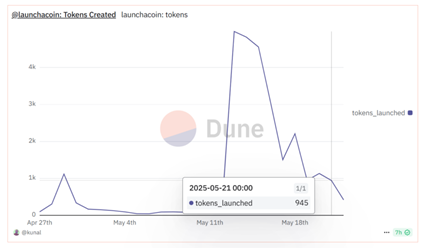

The boom of ICM saw nearly 5,000 tokens launched in just one day (May 13, 2025), but just a week later, this number dropped by nearly 80%, according to data from Dune. This raises questions about the sustainability of the model.

The future of ICM will depend on its ability to move from speculation to real value. Projects with practical products, clear services and sustainable development models can prolong the life cycle of this field.

Conclusion

Despite the risks and uncertainties surrounding sustainability, ICM is shaping a new era in capital raising – democratized, permissionless, and community-centric. Trends like tokenization, AI, and social media are just the beginning. It’s important to look beyond the hype and invest in ideas that have real long-term value.