3 Altcoins That Could Cause a Massive Liquidation Wave in the First Week of March

The first week of March saw a sharp move in the cryptocurrency market. News from President Trump, including his consideration of altcoins in the national cryptocurrency reserve and new tax policies, caused significant capital flows. This led to market liquidation volumes surpassing the $1 billion mark.

Liquidation data shows an imbalance among altcoins, raising concerns about the possibility of large liquidations in the near future.

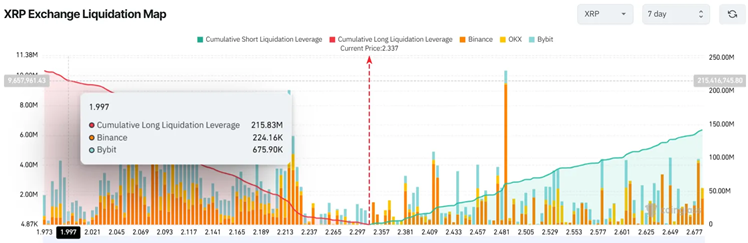

1. XRP (XRP)

XRP’s 7-day liquidation data indicates that if XRP’s price falls below $2, total long liquidations could exceed $215 million.

XRP is currently trading at $2.33, after falling 20% since March 3. The massive inflow into the XRP market was triggered after President Trump announced that XRP would be considered for inclusion in the US cryptocurrency reserve.

On March 3, 500 million XRP were unlocked from escrow, reported by Whale Alert. In addition, on-chain investigator ZachXBT revealed that Ripple co-founder Chris Larsen still holds over 2.7 billion XRP ($7.18 billion), and transferred over $109 million worth of XRP to exchanges in January 2025.

These factors could create major volatility in the XRP market and prompt liquidations.

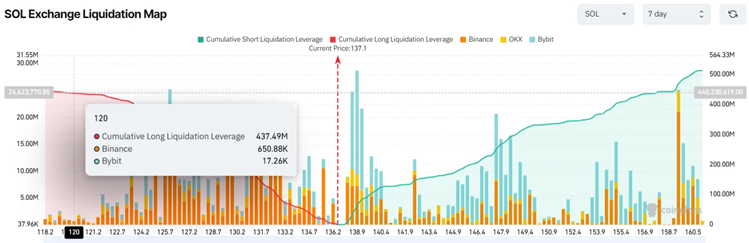

2. Solana (SOL)

Solana (SOL) 7-day liquidation data shows the possibility of large liquidations worth over $437 million if SOL’s price drops to $120. SOL is currently trading around $136.30, and a further 11% drop would trigger a wave of liquidations.

On-chain analysts from Lookonchain reported that a wallet associated with FTX/Alameda, holding over 3.03 million SOL ($431 million), has started moving funds to Binance. This development could signal large liquidations in the future.

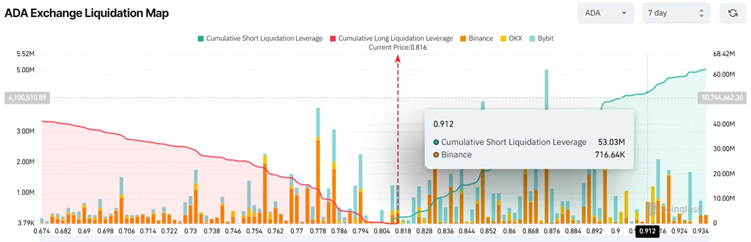

3. Ethereum (ETH)

Ethereum is also at risk of a large liquidation. The liquidation heat map shows that if ETH drops to $1,200, the total value of long-term liquidations could reach over $680 million.

As of now, ETH is trading around $1,330, down more than 15% since the beginning of March. With the strong growth of smart contracts and DeFi protocols, any major price correction could lead to significant liquidation incidents.

Similar to XRP and SOL, Ethereum is also affected by new policies and market volatility, increasing the risk of liquidation in the near term.