$3.29 Billion Bitcoin and Ethereum Options Expire: Price Impact

The crypto market is gearing up for a major options expiration event, with $3.29 billion worth of Bitcoin and Ethereum options set to expire today. This development is expected to lead to short-term price volatility, which could directly impact investors’ strategies and the profits they achieve.

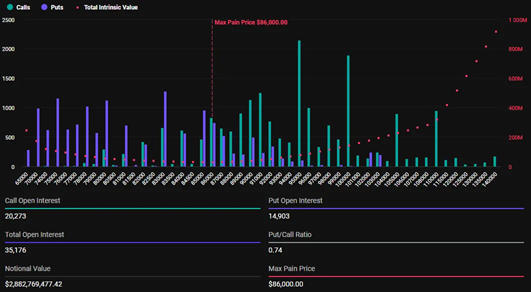

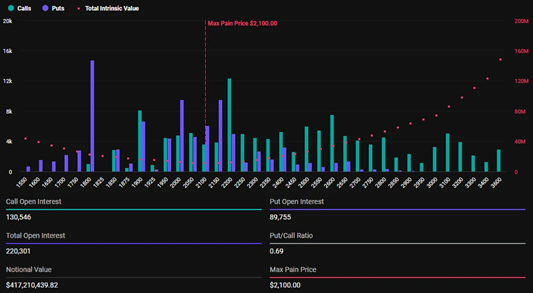

Of the total, Bitcoin (BTC) options account for the majority at $2.88 billion, while Ethereum (ETH) options account for the remaining $417 million.

Short-term volatility for Bitcoin and Ethereum

According to data from Deribit, there are 35,176 Bitcoin options contracts expiring today, significantly higher than last week’s 29,005 contracts. The put-to-call ratio for these contracts is 0.74, with the max pain set at $86,000. This suggests that traders are bullish on Bitcoin despite the price still hovering below $90,000.

Meanwhile, the number of Ethereum options expiring is 220,301 contracts, down slightly from last week’s 223,395 contracts. The put-to-call ratio is 0.69, with the max pain set at $2,100. Expect a sharp move in ETH prices as these options expire.

Trade online risk-free with TonTrader - a seamless trading platform that doesn’t require a complex interface.

When the options expire at 8:00 UTC today, there is a chance that Bitcoin and Ethereum prices will move towards their max pain levels. Currently, according to BeInCrypto data, Bitcoin is trading at $81,992, while Ethereum is at $1,891. This suggests that the price could recover in the near term as investors attempt to push the price back to its maximum pain level.

However, after the options contracts expire at 8:00 UTC, the pressure on BTC and ETH prices may ease. However, the large size of these expiring contracts could fuel increased volatility in the crypto market in the short term.

Current Market Sentiment

According to analysis from Greeks.live, the short-term market sentiment is currently tilted to the downside, despite positive signals from the US CPI (Consumer Price Index) data last week. Many traders are eyeing key support levels, with some suggesting that the $60,000 mark could be the next downside target for Bitcoin.

Analysts also noted that US tariffs and inflation are having a greater impact on the market than geopolitical events, such as developments in the Ukraine peace deal.

Tony Stewart, a prominent analyst in the cryptocurrency space, commented on the shift in trading strategies in the options market. According to him, traders adjusted their strategies from bullish positions in March to more cautious positions in April and May, especially after the sharp drop on March 11 and the subsequent recovery that was less supportive.

Stewart also pointed out that these changes are a sign of a psychological shift in the cryptocurrency market, with clear adjustments in approaches and predictions of market volatility in the coming period.